What Is DDP Shipping? - Delivery Duty Paid

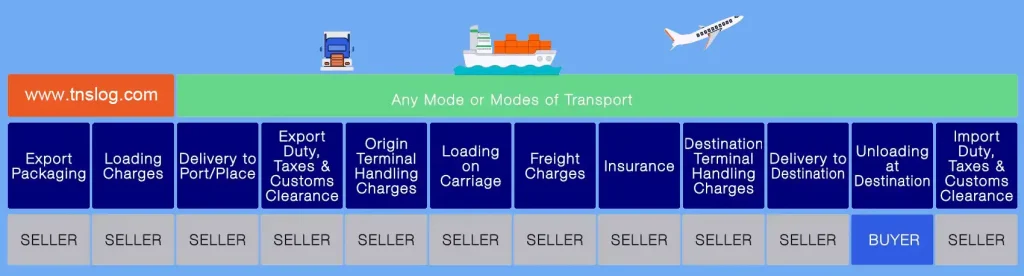

Delivered Duty Paid (DDP) shipping is a buyer-friendly Incoterms® rule that transfers all risks and costs to the seller until the goods reach the buyer’s designated destination. For Malaysian exporters, this means hassle-free door-to-door delivery for customers—covering export customs clearance, freight, import duties, taxes, and final handover services.

As a leading Malaysian logistics company with over 15 years of freight forwarding experience, TNSLOG SERVICES SDN BHD specializes in customizing DDP solutions for exporters. Whether you’re shipping palm oil to the US or electronics to Europe, we can help you seamlessly deliver your goods to your customers using DDP.

Responsibilities and risks of DDP delivery method

There are significant differences between DDP and ocean freight terms such as FOB or CFR. In order to facilitate your better understanding, I will provide you with a detailed analysis of key information such as delivery responsibility and risk bearing for DDP

1. Seller's Full Responsibility and Risk Transfer

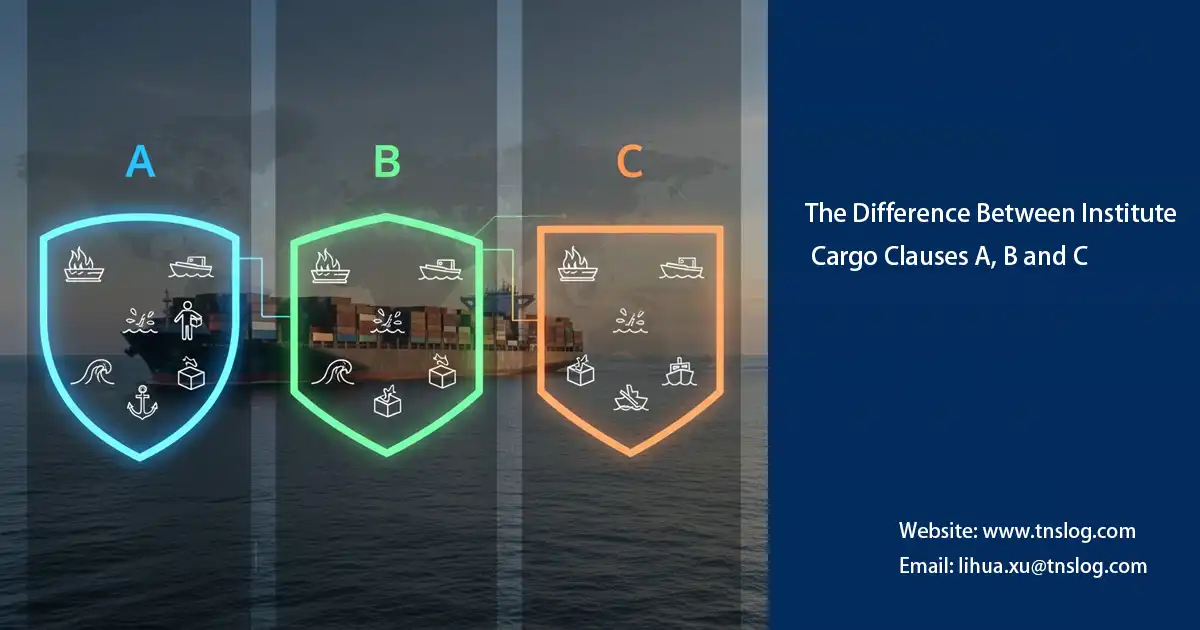

Under DDP terms, the seller’s responsibilities cover the entire logistics chain from origin to destination. The seller is not only responsible for packing and shipping the goods from their premises but also has full responsibility for arranging and paying all transportation costs from the point of shipment to the final destination, including ocean, air, or road freight. The seller’s risk transfer occurs at a very late stage: only when the goods arrive at the named destination, are ready for unloading on the means of transport, and are placed at the buyer’s disposal. This means that the seller bears the entire risk of loss or damage to the goods throughout the cross-border transit—whether in the country of export, on the main route, or inland in the importing country. Therefore, while not mandatory under Incoterms, sellers must purchase full cargo insurance to mitigate this risk.

2. Customs, taxes, and the biggest challenge

Beyond handling export customs clearance, the seller’s greatest responsibility lies in delivering the goods to the importing country. The seller is responsible for import customs clearance in the destination country and, more importantly, pays all import-related fees, duties, and taxes such as Value Added Tax (VAT) and Goods and Services Tax (GST). This requires the seller to have a thorough understanding of the destination country’s customs procedures and tax regulations and to have reliable resources. Any additional costs and risks incurred due to customs clearance delays, incomplete documentation, or tax miscalculation will be borne by the seller. This is the most challenging and costly aspect of DDP for the seller.

3. Risks and responsibilities that the buyer needs to bear

Compared to the risks and responsibilities borne by the seller, the buyer bears virtually no risk or responsibility, often referred to as the “least worry” trade method. The buyer’s primary responsibilities are simple: pay the contractual price and unload and receive the goods upon arrival at the designated destination. Since all freight, duties, and taxes are handled and paid by the seller, the buyer is freed from the hassles of customs clearance, logistics arrangements, and unexpected expenses.

Workflow under DDP transaction terms

To help you better understand DDP transaction terms, I’ve included a real-world example of shipping from a factory in Penang, Malaysia to New York, USA. This real-world example will help you better understand each specific step of the DDP transaction terms.

1. Goods Collection and Export Preparation (Malaysia)

- Factory Collection Arrangements: The freight forwarder will arrange appropriate vehicles and personnel to collect the goods from your factory in Penang on the designated shipping date. This includes checking the quantity, packaging integrity, and consistency with the pre-ordered manifest.

- Goods Verification and Initial Document Review: At the collection site, the freight forwarder’s staff will verify basic documents such as the commercial invoice and packing list.

- Malaysia Export Customs Clearance: The freight forwarder will be responsible for all Malaysian customs declarations. This involves preparing the export declaration, submitting the necessary export permits, and ensuring the goods are legally shipped abroad. The freight forwarder will calculate and pay all local export fees in advance.

2. Freight booking and strategy selection

- Transport Mode Matching: Freight forwarders will determine the optimal transport mode – air or ocean (less-than-container load (LCL) or full-container load (FCL) – based on the customer’s required delivery time and cargo characteristics (size, weight, and value).

- Capacity Booking and Documentation Preparation: We will promptly book space with airlines or shipping companies and prepare key shipping documents, such as ocean bills of lading (B/L) and air waybills (AWB).

- Special Handling Coordination: If the cargo requires special handling (such as temperature control or dangerous goods declaration), the freight forwarder will provide professional coordination and document preparation in advance.

3. Transportation, cargo monitoring and risk management

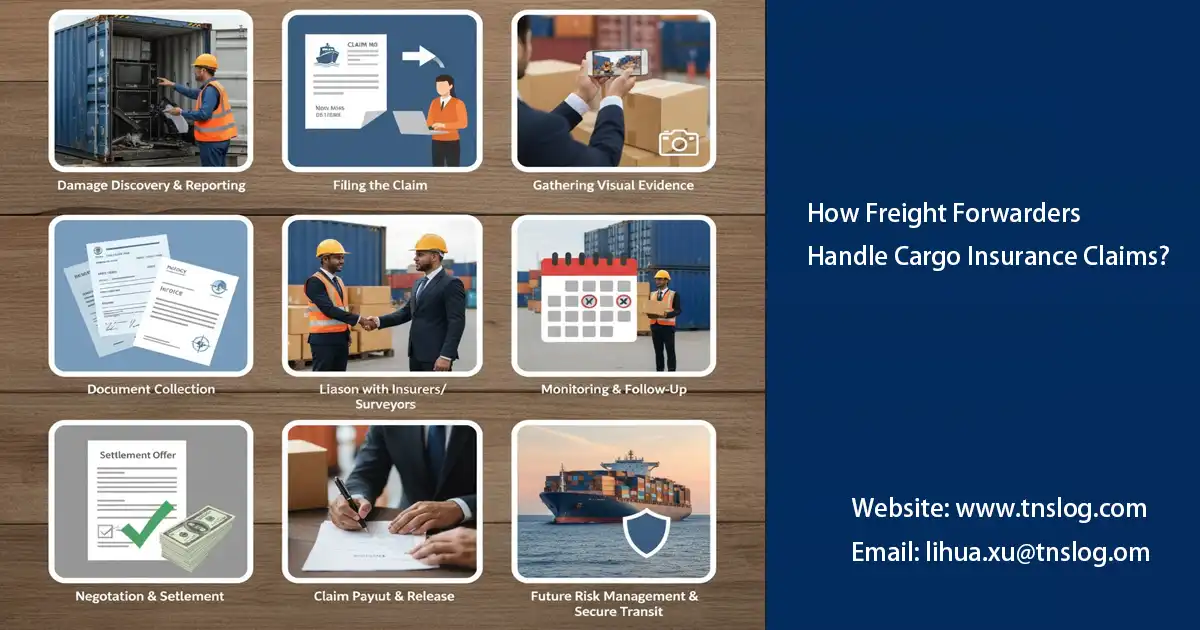

- Global Insurance Coverage: The freight forwarder will insure your shipment with all-risk insurance, covering the entire journey from the Penang warehouse to the New York warehouse. In the event of loss or damage, the freight forwarder or shipping company will be responsible for claim settlement.

- Real-Time Cargo Monitoring: Utilizing GPS tracking or other advanced logistics monitoring systems, the freight forwarder ensures that you and your internal team can view the location and status of your shipment in real time, receiving updates at key milestones (such as loading/departure and arrival at transit points).

- Exception Handling: In the event of delays, weather disruptions, or unexpected customs inspections, the freight forwarder will proactively intervene, conduct risk assessments, and quickly resolve issues to minimize impact on delivery times.

4. Import customs clearance and tax prepayment (US side)

- US Import Clearance: Upon arrival, your freight forwarder will be responsible for all customs clearance procedures with US Customs and Border Protection (CBP). This includes submitting necessary import documentation, complying with US safety regulations (such as AMS/ISF declarations), and requirements of agencies such as the Food and Drug Administration (FDA), as applicable.

- Prepaid Duties and Taxes: Your freight forwarder will calculate and pay all federal duties (e.g., 5%-10% for electronics) and applicable excise taxes upfront, ensuring your shipment enters the US duty-paid.

- Customs Document Accuracy: Your freight forwarder will ensure the accuracy of all documentation to avoid fines or cargo seizures due to incorrect declarations.

5. Final Delivery: From Port to New York Warehouse

- Inland Transportation Arrangement: We coordinate with specialized US inland carriers to transport the goods from the port of entry (usually Los Angeles, Long Beach, or the Port of New York/New Jersey) to the New York warehouse.

- Final Delivery: The goods are safely delivered to the New York warehouse according to the pre-agreed delivery time.

- Proof of Delivery (POD): We obtain and provide you with a valid Proof of Delivery, which officially fulfills the DDP obligation and transfers full risk to the buyer.

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!