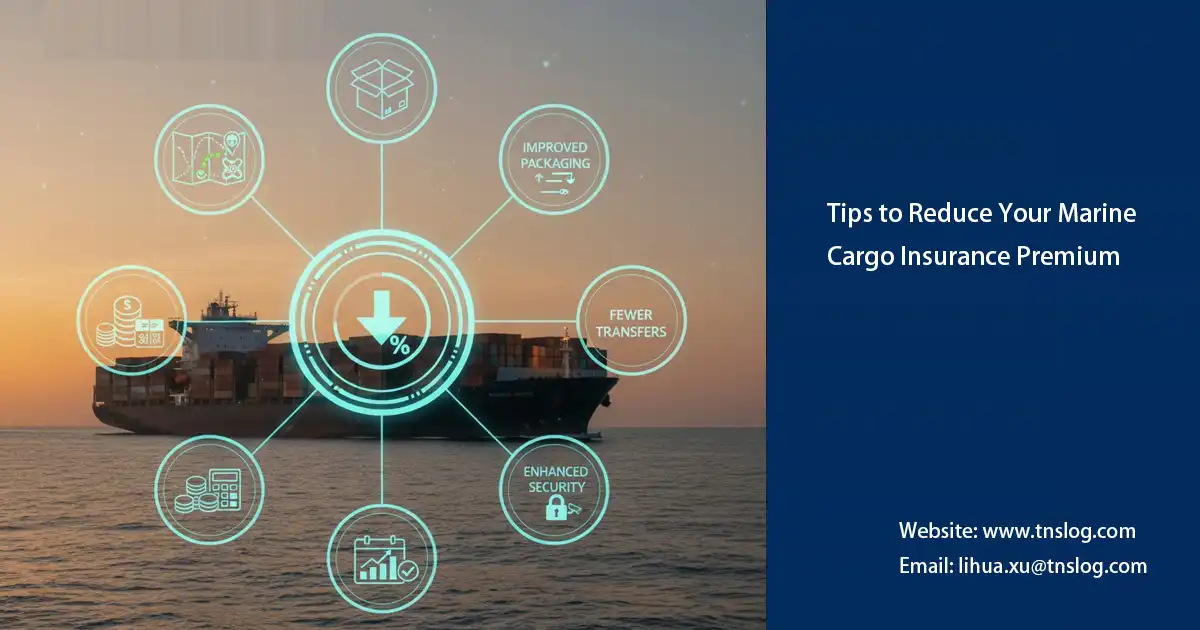

Tips to Reduce Your Marine Cargo Insurance Premium

In a time when global shipping costs continue to rise, more and more businesses are looking for ways to achieve marine cargo premium reduction without compromising on risk coverage. For exporters, importers, and manufacturers who rely heavily on international sea freight, the marine cargo insurance premium represents a significant portion of total logistics expenses.

According to the International Union of Marine Insurance (IUMI), insurance costs typically account for 0.3%–2.5% of cargo value, but for high-risk routes or high-value shipments, the ratio can be much higher.

So, what drives marine insurance premiums up—and how can companies effectively optimize their marine insurance cost? This article explores five professional, data-backed strategies to help you achieve sustainable marine cargo premium reduction while maintaining full protection.

Consolidating Shipments: Optimize Freight Frequency to Reduce Risk Exposure

Shipment frequency and cargo value per consignment are major factors in how insurers calculate risk. Multiple small shipments are viewed as repeated exposure events—each with its own handling, loading, and transit risks.

Consolidating shipments into fewer, larger consignments (e.g., converting multiple LCL shipments into one FCL) can lower your exposure and improve your risk profile.

For example, a Malaysian exporter of home appliance components reduced their marine cargo insurance premium by 22% after consolidating 12 monthly LCL shipments into 3 FCL shipments.

By minimizing touchpoints and transit events, consolidation not only reduces the likelihood of loss or damage but also leads to marine insurance cost optimization.

👉 Related reading: Factors That Influence Marine Insurance Costs

Proper Packaging and Risk Mitigation: Strengthen Packaging Standards to Lower Risk Ratings

In marine insurance underwriting, packaging quality is one of the most influential factors affecting your premium. Studies show that up to 40% of cargo claims are linked to poor packaging.

Proper packaging demonstrates effective risk control, which insurers reward with lower rates. Here are practical measures that contribute directly to marine cargo premium reduction:

- Moisture-proof and shock-resistant materials — essential for electronics and perishable goods.

- Cargo restraint and anti-shift devices — air cushions, straps, and corner protectors reduce movement.

- Temperature-controlled or corrosion-resistant packaging — ideal for pharmaceuticals or chemicals.

In one case, a company that implemented vibration-proof packaging and container bracing achieved a 12–18% reduction in their marine cargo premium.

Choosing the Right Policy Type: Select the Most Cost-Effective Coverage for Each Risk Profile

Different types of marine cargo insurance policies come with distinct rate structures. An “All Risks” policy offers the widest coverage but commands the highest premium, while “With Average” (WA) or “Free from Particular Average” (FPA) policies offer lower-cost options for specific conditions.

The key is matching policy type with shipment risk level rather than defaulting to the most comprehensive plan.

Strategic recommendations:

- Use FPA for low-risk, short-haul routes (e.g., intra-ASEAN trade) — potential savings of 10–15%.

- Choose All Risks for high-value or high-risk cargo, such as precision machinery or electronics.

- Consider annual blanket policies for frequent shipments — average savings of up to 20%.

👉 Related reading: Marine Insurance for High-Value Cargo

Negotiating with Insurers: Leverage Data Transparency and Reliability to Secure Better Rates

Marine insurers assess premiums based on claim ratios, route risk, and cargo category. However, proactive negotiation can help companies reduce premiums significantly.

Effective negotiation strategies include:

- Presenting a clean claims history — maintaining a zero-claim record for 3+ years can earn a 10–25% discount.

- Providing detailed risk control documentation — outlining packaging standards, tracking systems, and warehouse conditions.

- Signing long-term contracts — insurers prefer stable clients and often reward them with lower rates.

- Bundling coverage — combining marine, warehouse, and inland insurance can reduce overall costs by 5–8%.

Negotiation isn’t about pushing for discounts; it’s about proving risk transparency and control.

Working with Trusted Freight Forwarders: Partner with Professionals for Systematic Cost Optimization

A trusted freight forwarder is more than just a logistics provider—they are a key partner in marine insurance cost control. Established forwarders often have long-term relationships with insurance underwriters, allowing them to offer clients access to group-rate premiums and customized coverage options.

They can also provide professional support in:

- Reviewing and optimizing insurance policies;

- Standardizing cargo insurance processes;

- Assisting with claims and documentation;

- Generating annual marine insurance cost analysis reports.

By collaborating with a reputable freight forwarder, shippers can achieve not only marine cargo premium reduction but also enhanced efficiency and transparency across the supply chain.

Conclusion

Reducing your marine cargo insurance premium isn’t just about cutting costs—it’s about building a resilient, data-driven risk management system. Through shipment consolidation, professional packaging, smart policy selection, data-backed negotiations, and expert partnerships, businesses can achieve long-term, sustainable marine insurance premium optimization.

To understand how insurers calculate premiums, see: How Marine Insurance Premiums Are Calculated

For insights into protecting high-value goods, visit: Marine Insurance for High-Value Cargo

In today’s volatile global trade environment, mastering these strategies not only helps lower costs but also strengthens your company’s competitiveness and supply chain resilience.

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!