How to choose marine insurance for high-value cargo?

When your cargo is worth hundreds of thousands or even millions of dollars, do you truly understand whether ordinary marine insurance can cover all your risks? Do you know that in the event of damage or loss, complex claims processes and missing documentation can lead to claims being denied? Marine insurance for high-value cargo is more than just a piece of paper; it’s a critical measure to protect your financial security and business continuity

Why high-value cargo requires specialized marine insurance?

High-value cargo carries significantly higher risks during transportation than ordinary cargo. For example, luxury goods, precision machinery, or high-end electronic equipment are subject to damage, theft, or delays at every stage of transportation, and standard insurance may not cover all risks. Furthermore, the claims process for high-value cargo is more complex, and incomplete documentation or declarations can lead to partial or full denial of claims.

Specialized high-value cargo insurance can provide:

- Customized protection covering different risk types;

- Clear coverage and compensation standards;

- Efficient claims processing mechanisms.

Key risks in transporting high-value goods

Physical Damage Risk

High-value cargo is often large and heavy, making it vulnerable to improper handling or turbulent transport. Improper packaging, unsecured cargo, or improper container stacking can result in partial or total loss.

Theft and Stolen Risk

Luxury goods and high-end electronics are easy targets for theft, especially in port warehouses or during transit. Insurance for high-value cargo typically requires that the cargo be stored by a secure carrier or in a monitored warehouse.

Transport Accident Risk

Ship collisions, container collapses, port accidents, or extreme weather can all result in cargo loss. Some insurance policies require the use of specific routes or vessel types; failure to do so may affect compensation.

Delay and Mishandling Risk

High-value cargo has strict delivery timelines, and delays can result in lost business opportunities, contractual penalties, or additional storage costs. Insurance policies should clearly cover delay risks and their payout terms.

Political and Piracy Risk

Certain shipping routes carry the risk of piracy or political instability, making high-value cargo more vulnerable to attack. Insurance policies should clearly cover these specific risks or provide additional clauses.

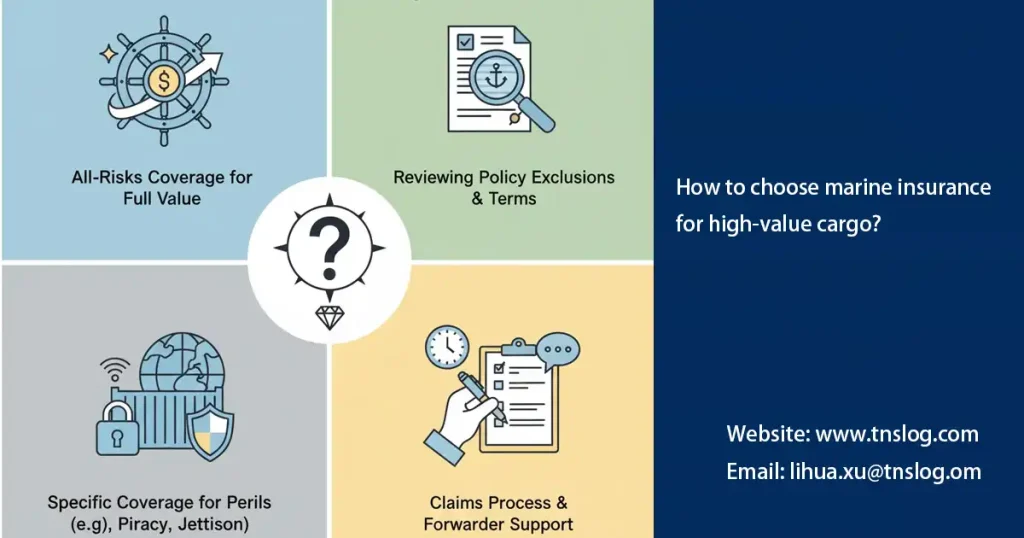

How to choose the right marine insurance for high-value cargo?

1. Verify the insurance type and coverage

For high-value cargo, ICC (A) all-risk insurance is generally the most suitable, as it covers almost all potential losses, with only a few exclusions. Before choosing, consider:

- Is it inclusive of damage during loading and unloading?

- Is it inclusive of the additional risks associated with temperature-controlled, fragile goods, or specific transport conditions?

- Available additional riders, such as delay or specific natural disaster coverage.

👉 For more information on insurance options, please refer to: “Overview of Main Types of Marine Cargo Insurance”

2. Ensure the insurance amount and insured value are reasonable

- Cost of Goods: Insure based on the invoice value.

- Freight and Duties: Transportation and import-related costs should be included in the insured amount.

- Potential Additional Losses: We recommend adding a 10–20% risk buffer.

High-value goods often involve multiple shipments, so it’s recommended to purchase full-haul insurance coverage rather than a single shipment policy to avoid underinsurance on a single shipment.

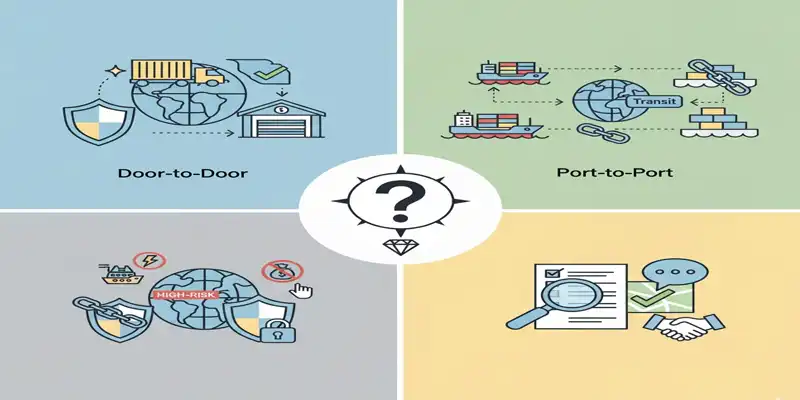

3. Geographical Coverage and Transportation Route Coverage

High-value goods often cross borders and travel across multiple modes, so it’s crucial to ensure your policy covers:

- Door-to-Door: Coverage from the shipping warehouse to the customer’s warehouse.

- Port-to-Port: Coverage is also required for risks associated with transshipment or intermediate storage.

- Additional Route Risks: Additional clauses may be required for areas with political instability or high theft rates.

Detailed geographic coverage can reduce blind spots and avoid claims disputes.

4. Claims Processing and Freight Forwarder Collaboration

The claims process for high-value cargo is complex and typically requires:

- Complete documentation (bill of lading, packing list, commercial invoice, insurance documents, etc.);

- A responsive claims processing team;

- Clear claims policies and document templates.

Working with an experienced freight forwarder can expedite the claims process and provide professional advice, ensuring your cargo is properly protected at every stage of transportation.

5. Collaborate with freight forwarders to optimize risk management

Professional freight forwarders can not only recommend appropriate insurance but also provide value-added services:

- Professional packaging and securing solutions;

- Temperature-controlled transportation advice and monitoring;

- Risk assessment reports and route optimization recommendations.

These measures can reduce the likelihood of cargo damage and the need for claims, while ensuring efficient and stable business operations.

6. Manage Premiums While Maintaining Adequate Coverage

High-value cargo insurance costs are higher, but these can be mitigated by:

- Using certified packaging and carriers;

- Avoiding high-risk shipping routes;

- Using annual policies to cover multiple shipments and reduce individual premiums.

For more cost-saving tips, please refer to “Tips to Reduce Your Marine Cargo Insurance Premium.”

Conclusion: High-value cargo insurance is a key financial safeguard for businesses.

Marine insurance for high-value cargo is essential. It not only ensures cargo safety but also reduces claims disputes and operational losses. Whether it’s luxury goods, precision equipment, or high-end electronics, choosing professional insurance and a reliable freight forwarder is key to ensuring the safe arrival of your cargo from origin to destination.

Contact us today to learn how to tailor a comprehensive insurance solution for your high-value cargo, ensuring safe and efficient transportation.

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!