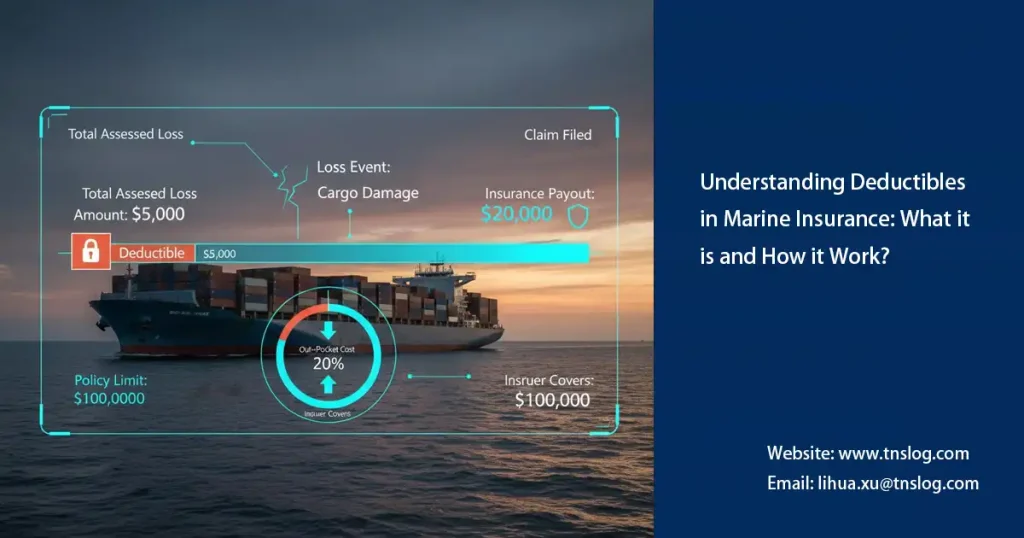

Understanding Deductibles in Marine Insurance: What it is and How it Work

Have you ever filed a marine cargo insurance claim and wondered why the payout was slightly less than the total loss amount?That difference is often due to the marine insurance deductible—an essential mechanism designed to share risk between the insurer and the insured.

Understanding Deductible in Marine Insurance

A deductible (also known as an “excess”) is the amount that the policyholder agrees to bear before the insurance company compensates for a claim. In marine insurance, the deductible helps balance the insurer’s liability and encourages shipowners, exporters, and importers to take preventive measures to minimize losses.

The deductible can be a fixed sum or a percentage of the insured value. For example, a vessel insured for ₹10,000,000 with a 1% deductible means the insured must bear ₹100,000 for each claim.

Choosing the right deductible level is crucial—it allows you to strike a balance between affordable marine insurance premiums and acceptable risk exposure.

👉 Learn more: How Marine Insurance Premiums Are Calculated?

Types of Marine Insurance Deductibles

a. Fixed Deductible

A fixed deductible means the policyholder pays a specific amount for every claim, regardless of its size.

Example: If your deductible is ₹50,000 and your total claim is ₹500,000, the insurer will pay ₹450,000 after deducting your share.

b. Percentage Deductible

A percentage deductible is based on the insured value or claim amount. For instance, if your insured value is ₹1,000,000 and the deductible is 5%, you’ll pay ₹50,000 before the insurer contributes.

c. Hull Insurance Deductible

Hull insurance covers the physical structure and machinery of a vessel. Its deductible may be a fixed amount or a percentage of the ship’s insured value. Some policies also apply higher deductibles for specific perils, such as storm or grounding damage.

d. Liability Insurance Deductible

Also known as Protection & Indemnity (P&I) insurance, this covers third-party liabilities arising from ship operations—like property damage or personal injury. Liability deductibles are usually fixed and calculated per incident.

e. Tiered Deductible

A tiered deductible varies depending on the size or nature of the claim. Smaller claims may have lower deductibles to encourage reporting, while larger claims come with higher deductibles to promote proactive risk management.

f. Per-Location Deductible

Some marine policies apply deductibles based on shipping routes or regions. For example, cargo shipped through high-risk regions (such as piracy-prone waters) might carry higher deductibles to reflect the increased risk.

How Deductibles Work in Marine Insurance Claims?

The deductible plays a critical role in determining the final claim payout. It reduces the insurer’s liability and motivates the insured to take preventive steps.

Let’s look at a quick example:

Insured Value: ₹5,000,000

Damage Amount: ₹500,000

Deductible: ₹50,000

Insurance Payout: ₹450,000 (after deductible)

Higher deductibles typically lower your marine insurance premium, while smaller deductibles may increase your premium cost. Some policies exclude deductibles under specific conditions, such as total loss or general average contributions.

Understanding how deductibles affect claims helps you choose a policy that aligns with your company’s risk tolerance and financial strategy. If you’re unsure about how to handle the claim process, check our Step-by-Step Guide to Filing a Marine Cargo Insurance Claim

How Deductibles Affect Marine Cargo Insurance Claims?

Deductibles directly influence your financial responsibility in every claim. Here’s how they shape your overall insurance experience:

- Financial Responsibility: You are responsible for paying the deductible amount before the insurer compensates.

- Claim Frequency: Higher deductibles often discourage filing minor claims, reducing claim frequency and lowering future premiums.

- Risk Behavior: Sharing part of the loss encourages more responsible and preventive management of cargo operations.

In short, the deductible is both a cost-control tool and a behavioral incentive—helping stabilize long-term insurance expenses.

Factors to Consider When Choosing a Deductible

Selecting the right deductible requires a careful evaluation of your company’s financial strength and risk profile.

- Financial Capacity – Ensure your business can comfortably handle the deductible amount without disrupting cash flow.

- Premium Costs – A higher deductible reduces premium costs, while a lower deductible increases them. Strike a balance between affordability and risk.

- Risk Exposure – If you expect frequent claims, a lower deductible may be more cost-effective.

- Asset Value – For high-value cargo, choose a smaller deductible to protect against large potential losses.

- Policy Terms – Always review your policy carefully for different deductible conditions across coverage types.

- Long-Term Financial Planning – Align deductible levels with your long-term business and risk management goals.

Tips for Managing Marine Insurance Deductibles

Understand Your Policy Terms – Know exactly when and how the deductible applies.

- Evaluate Risk Appetite – Match your deductible level to your financial capacity and risk tolerance.

- Maintain Proper Documentation – Detailed cargo records simplify the claims process.

- Strengthen Risk Controls – Use secure packaging, proper stowage, and reliable shipping partners to reduce claims.

- Negotiate Deductible Terms – Work with your insurer to explore flexible deductible structures.

- Bundle Policies – Combine marine insurance with other policies to achieve better deductible terms.

- Set Aside Reserves – Keep a fund to cover potential deductible payments.

- Track Claim Patterns – Monitor your claim frequency to negotiate better terms at renewal.

Conclusion

A marine insurance deductible is more than just a cost—it’s a financial safeguard that encourages responsible risk management. By understanding how deductibles work, businesses can make informed decisions when selecting marine insurance policies.

Balancing deductible levels with premium affordability, risk exposure, and policy coverage is key to achieving optimal protection. Through careful planning, negotiation, and collaboration with reliable freight forwarders, companies can achieve long-term marine insurance premium optimization and stronger financial resilience.

If you’re ready to review your coverage or want expert advice on marine cargo insurance deductibles, please contact us right now!

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!