Legal Rights of Shippers Under Marine Insurance Policies

When cargo moves across oceans, it faces countless risks—from rough weather to handling damage and theft. For shippers, understanding their legal rights under marine insurance policies is crucial to protecting their financial interests when unexpected losses occur. Too often, confusion over policy wording or responsibility between the shipper, carrier, and insurer leads to costly delays or rejected claims. This article explains the legal rights every shipper should know under a marine insurance policy and how to exercise them effectively.

Understanding the Legal Foundation of Marine Insurance

Marine insurance operates under long-established principles derived from maritime law and the Marine Insurance Act (such as the UK 1906 Act, which still influences global practice). These principles define the rights and obligations of both the insured (shipper or cargo owner) and the insurer.

Key concepts include:

Insurable interest – The shipper must have a legitimate financial interest in the cargo at the time of loss to claim compensation.

Utmost good faith (uberrimae fidei) – Both the insurer and insured must disclose all material facts before coverage is granted.

Indemnity – Insurance is designed to restore the insured to the same financial position as before the loss, not to provide profit.

These legal doctrines form the backbone of marine insurance and are essential for understanding what protections shippers can claim under their policy.

Primary Legal Rights of Shippers

1. Right to Full Disclosure and Fair Treatment

2. Right to Indemnity for Covered Losses

3. Right to Subrogation Protection

4. Right to Claim for General Average Contributions

If a General Average (GA) event occurs (such as cargo being jettisoned to save the ship), shippers are legally obligated to contribute proportionally. Under most policies, however, the insurer must reimburse the shipper’s GA contribution, ensuring they do not bear that financial burden personally.

5. Right to Transparent Claim Handling

Common Legal Disputes Between Shippers and Insurers

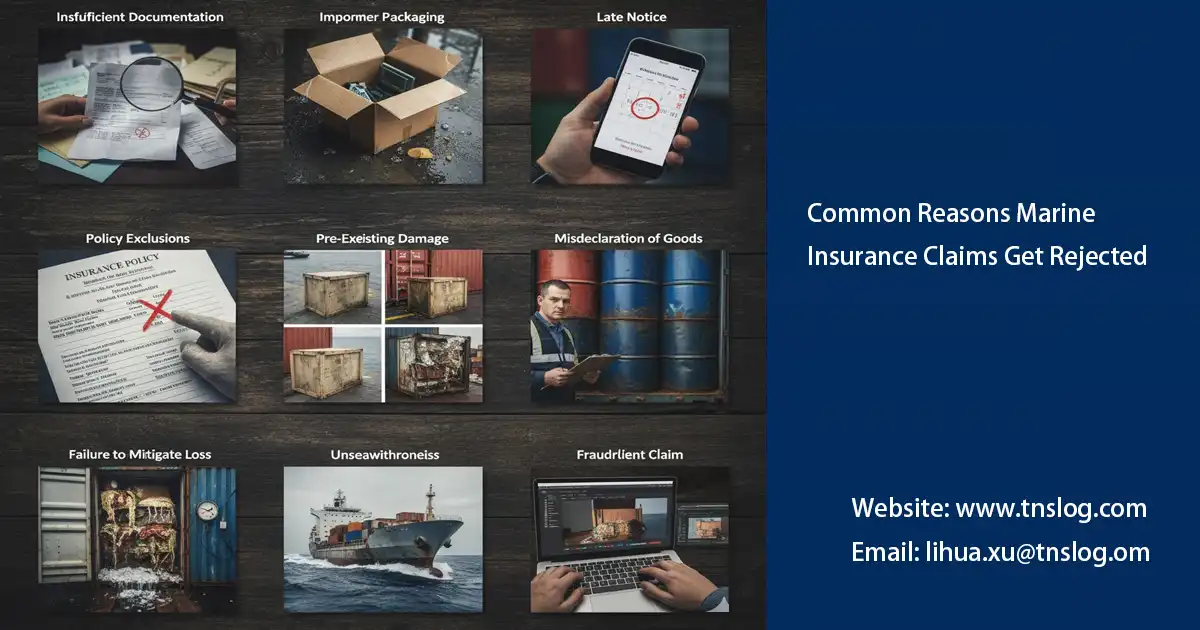

Even with clear contracts, disagreements often arise regarding:

- Coverage exclusions (e.g., inadequate packaging or inherent defect).

- Late notification of loss (failure to report within a stipulated time frame).

- Disputes over insurable interest (especially under CIF or FOB terms).

- Valuation disagreements (when declared value differs from actual cargo worth).

To minimize such disputes, shippers should ensure their policy aligns with the shipment’s Incoterms, coverage scope, and documentary requirements. Maintaining proper records—bills of lading, packing lists, insurance certificates, and invoices—is crucial during claim evaluation.

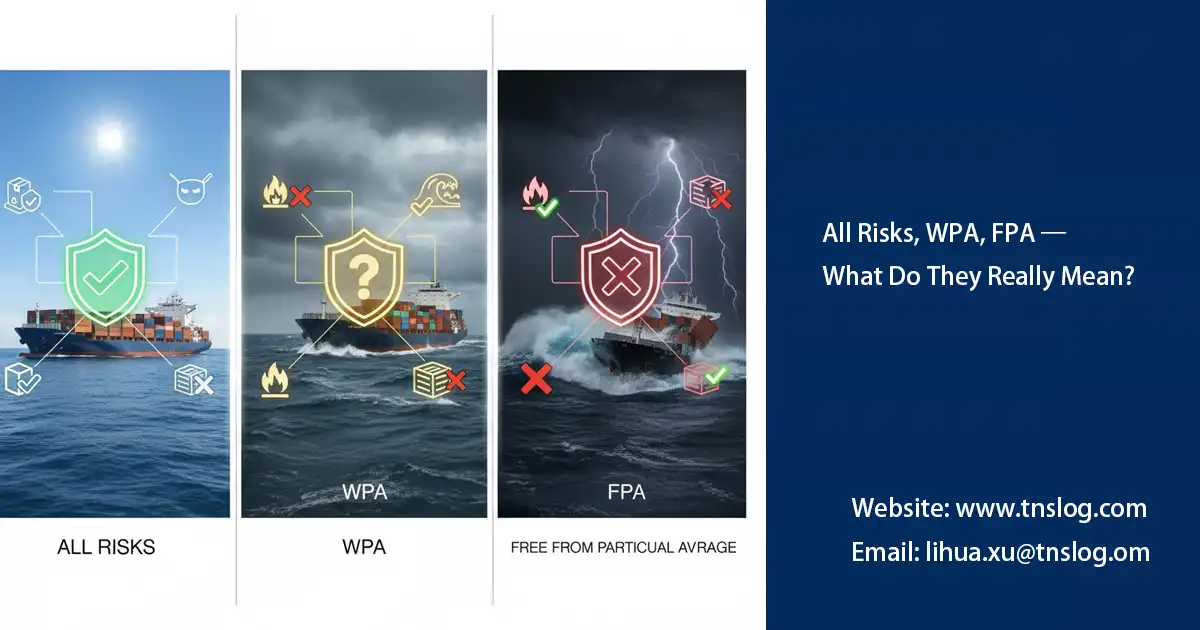

For more clarity on key policy terms that frequently appear in such disputes, refer to our detailed guide Common Terms You Must Know in Marine Cargo Insurance

Steps to Enforce Your Rights in Case of a Claim

- Notify your insurer immediately after discovering loss or damage.

- Document everything – photos, condition reports, and correspondence with carriers.

- Request a survey report – insurers often appoint independent surveyors to assess damage.

- Submit a complete claim file – including invoices, bill of lading, and insurance certificate.

- Follow up in writing – maintain written communication for all insurer interactions.

If the claim is denied, shippers have the legal right to:

- Request written justification.

- Appeal through internal review or mediation.

- Pursue arbitration or legal proceedings if necessary.

For a structured approach to managing claims, you can follow our Step-by-Step Guide to Filing a Marine Cargo Insurance Claim

Practical Tips for Protecting Your Rights

- Choose comprehensive coverage (ICC A) whenever possible to minimize dispute risks.

- Review policy terms carefully before shipment, especially exclusions and claim time limits.

- Ensure insurance aligns with Incoterms to confirm who bears risk and responsibility.

- Engage a professional freight forwarder to coordinate shipping documents and insurance arrangements.

- Keep communication records with the insurer to prove due diligence in claim handling.

An experienced freight forwarder can bridge the gap between shippers and insurers by ensuring every shipment has accurate insurance documentation and full coverage from port of loading to final destination.

Conclusion

Marine insurance policies offer critical protection for shippers, but understanding your legal rights ensures you can actually benefit from that protection when things go wrong. From the right to indemnity to the right to fair treatment and transparent claims, knowing how these principles apply in practice can mean the difference between a smooth settlement and a costly dispute.

As a professional freight forwarder in Malaysia, we help exporters and importers navigate the complexities of marine insurance—from policy setup to claim management—so you can ship with confidence. Contact us today to ensure your marine insurance policy truly protects your cargo and your business interests.

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!