Common Terms You Must Know in Marine Cargo Insurance

Common terms in marine cargo insurance include insurable interest, which is the financial stake in the goods, and indemnity, where the insurer restores the insured to their pre-loss financial position. Key document terms are the bill of lading, which is the contract of carriage, and INCOTERMS, which define buyer/seller responsibilities. Other terms relate to clauses, like the valuation clause that sets the insured value, and average, which can be general average (shared loss) or particular average (a partial loss).

As a Malaysian freight forwarder with years of real-world experience, we have extensive expertise in this field. Ready to build your marine insurance glossary? Let’s break it down from the basics. For a deeper dive into your policy options, check out our guide on Overview of Main Types of Marine Cargo Insurance.

Explanation of Basic Terms of Marine Cargo Insurance

In marine cargo insurance, these terms form the backbone of policies based on standards like the Institute Cargo Clauses (ICC). Understanding them ensures you’re not overpaying or underprotected. We’ll define each term, add real-world context, and highlight its meaning—tailored specifically for exporters and importers on high-traffic routes like Asia-Europe.

Actual Total Loss

Contingent Insurance

Contingent insurance in shipping is a secondary type of coverage that protects freight brokers and other intermediaries, activating when the primary cargo insurance of the carrier fails to cover a loss due to issues like gaps, exclusions, or insufficient limits. It acts as a safety net, providing a financial backup to cover damages or theft that the carrier’s own policy doesn’t handle, thereby shielding the broker from financial liability.

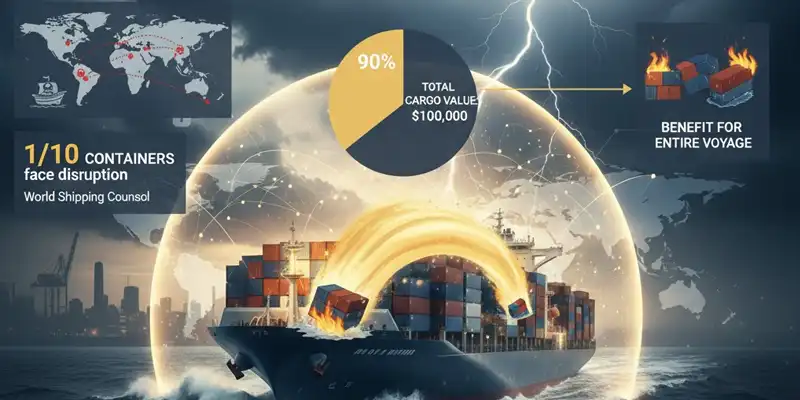

Contributory Value

The Contributory Value is used to calculate the proportionate share of cargo value in a general average (GA) scenario, where a sacrifice (such as abandonment) benefits the entire voyage. If your $100,000 worth of electronics contributes to a total GA claim of $1 million, your share is based on this value, not the full policy amount. This marine cargo insurance term highlights why accurate valuation upfront can save you the trouble of common loss adjustments.

Conveyance

Jettison

Valuation Clause

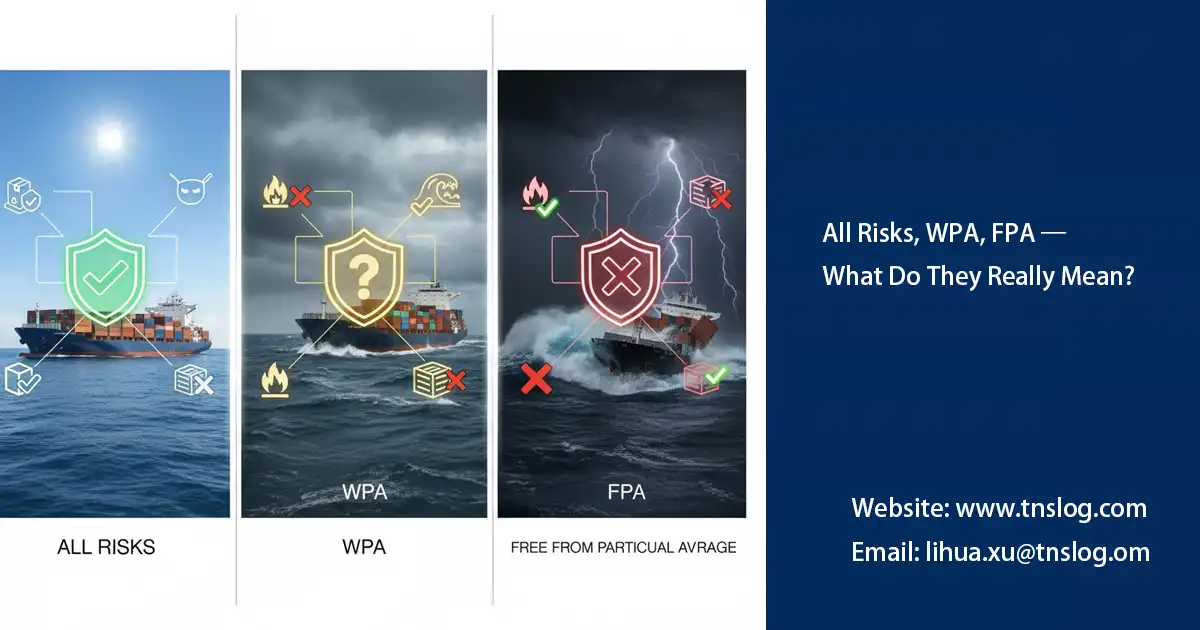

All-Risk Coverage

Barratry Clause

Cargo Interest

These common marine cargo insurance terms are interrelated: abandoning cargo can result in a contributed value calculation based on an all-risks policy, and all of this is relevant to your valuation clause. To understand how they work in practice, explore *How Marine Cargo Insurance Works in International Trade*.

Conclusion

As an importer or exporter in global trade, it’s difficult to fully grasp all the marine cargo insurance terminology. To reduce the financial losses caused by marine risks, you should choose to work with a professional Malaysian freight forwarding company like us. If you have experienced cargo loss and are having trouble filing a claim, you can check out our professional tutorial Step-by-Step Guide to Filing a Marine Cargo Insurance Claim.

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!