Why Marine Insurance Is Essential for Shipping Electronics Safely?

Shipping electronics is not the same as shipping generic cargo. Circuitry, displays, batteries and precision assemblies are vulnerable to moisture, shock, ESD, temperature swings and theft — and a single failure in the cold chain, handling or documentation can turn a profitable shipment into a total loss and a long, expensive claim fight. That’s why marine insurance for electronics shipments isn’t optional: it’s a core risk-control tool that, when combined with correct packaging and operations, protects both product value and business continuity.

Below is a practical, detailed guide that explains the real risks electronics face at sea, what an appropriate insurance program should cover, and the operational steps buyers and shippers must take to maximise the chance of a successful claim if the worst happens.

The real risks electronics face in ocean transport

Electronics are exposed to a cluster of failure modes during ocean transport. Understanding these specifically helps you choose cover and mitigation steps that actually work:

- Moisture & Humidity (corrosion / mould / PCB failure): Condensation inside packages or containers can corrode contacts and circuit traces. Salt air in ports accelerates corrosion.

- Vibration & Shock (mechanical damage): Repeated vibration during long sea legs, or single-impact events during loading/unloading, can crack solder joints or lenses.

- Electrostatic Discharge (ESD): Improper packing or ungrounded handling procedures can generate damaging static spikes.

- Temperature excursions: High ambient heat or repeated thermal cycles can damage batteries, adhesives and sensitive components.

- Lithium battery hazards: Batteries bring special safety rules, additional documentation and sometimes additional exclusions or endorsements on insurance.

- Theft & pilferage: High-value consumer electronics are targeted in ports and intermediate warehouses.

- Documentation and compliance failures: Wrong HS codes, missing declarations for hazardous elements (e.g., batteries), or missing certificates often cause delays or claim denials.

These are not abstract risks — they’re the common causes of partial or total losses for electronics in ocean shipping. Insurance must be selected and structured with these in mind.

What the right marine insurance for electronics should cover?

A suitable policy goes beyond “basic cargo cover.” Look for the following elements when evaluating insurers or policies:

- Policy type — prefer All Risks (ICC A) for high-value electronics.

ICC A (All Risks) covers most causes of loss except specified exclusions. For electronics, this is usually necessary because partial damage (moisture, shock) is common and expensive. - Declared value and invoice-based sum insured.

Insure goods at full landed value: product cost + freight + duties + a margin (commonly 10–20%) to cover incidental expenses. Under-insurance reduces payout proportionally. - Specific endorsements for batteries and hazardous components.

If consignments contain lithium batteries or other controlled components, require specific wording that recognizes legally compliant battery shipments. - Temperature / humidity deviation coverage (if relevant).

For temperature-sensitive electronics or assemblies with adhesives, consider a rider that covers losses from temperature/humidity excursions documented by data loggers. - Shipment wording: door-to-door / named perils / coverage geographic scope.

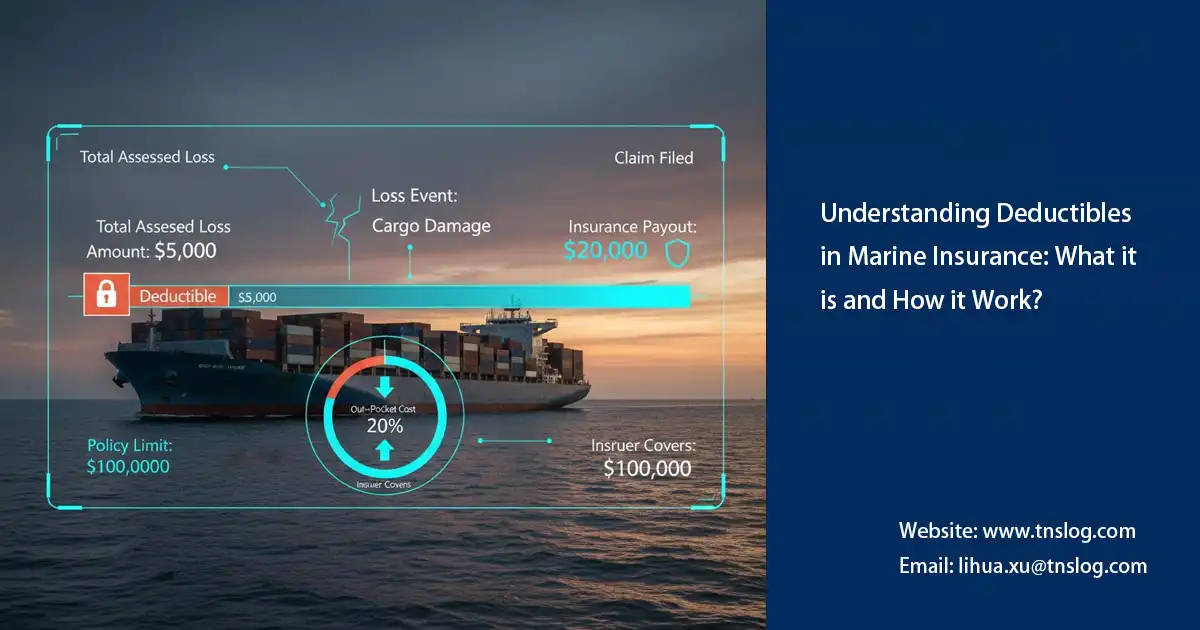

Ensure the policy wording matches your logistical reality (door-to-door if you arrange final-mile, or port-to-port if you handle inland legs separately). - Sub-limits & deductibles — read them carefully.

Policies may have sub-limits for items such as “shortage,” “delay,” or “theft from warehouse.” Confirm amounts and negotiate where possible. - Third-party liability cover for contamination or cargo-caused damage.

If a failing battery can cause a fire and damage a ship or other cargo, you need liability protection in addition to cargo cover. - Clear claims process & insurer reputation.

Fast investigation, accepted surveyors, and a history of paying valid claims promptly matters when product shelf-life or cash flow is at stake.

If you ship electronics regularly, ask for an insured-program proposal (not just single-voyage certificates) so you can negotiate terms, premiums and claims SLAs that reflect volume and loss history.

Operational measures that reduce risk — insurance works better when operations are tight

Pre-shipment / packing:

- Use anti-static inner packaging (ESD bags, conductive foam) and vibration-damping materials.

- Install humidity absorbers (silica gel) and humidity indicator cards inside boxes for sea transit.

- Seal cartons with tamper-evident tape and mark pallets/container doors with humidity and temperature warnings.

Container stuffing & stowage:

- Use certified palletization and blocking/bracing to prevent movement.

- Avoid double-stacking heavy loads on delicate electronics.

- Ensure container ventilation when required, and use desiccant if condensation risk exists.

Monitoring:

- Fit temperature/humidity data loggers (with time stamps) or real-time IoT sensors for high-value consignments. Logs are invaluable evidence for claims.

- Retain tracking history (GPS/telemetry) and capture CCTV or terminal handover proof if available.

Documentation & compliance:

- Declare batteries and other hazardous components correctly (UN numbers, packing instructions, MSDS).

- Keep pre-shipment photos (packaging & pallet configuration), test reports, factory QC records and bill of lading / AWB on file.

- Maintain chain-of-custody records when cargo is moved between handlers.

Carrier & route selection:

- Avoid known high-theft hubs or transshipment points when alternatives exist.

- Choose carriers with experience in electronics and a strong claims-handling record.

Training & SOPs:

- Train packers, warehouse staff and stevedores on ESD precautions, hydration control and gentle handling SOPs.

- Implement a checklist for temperature-sensitive or battery-including shipments.

Preparing to make a successful claim (documentation & timing)

When a loss happens, the difference between acceptance and rejection is often paperwork and timing:

- Immediate actions: Photograph the exterior (seal numbers, container condition), then photograph internal packaging, damaged units, and humidity/temperature indicators. Retain damaged samples for survey.

- Documentation to assemble: Commercial invoice, packing list, bill of lading/air waybill, insurance certificate/policy wording, pre-shipment photos, QC/test reports, log data from temperature/humidity devices, surveyor report (independent if requested), and correspondence with carriers.

- Notice & time limits: Most policies require notice to insurer and sometimes to carrier within short windows (e.g., 3–7 days for visible damage). Complying with notice periods is essential.

- Preservation of evidence: Do not dispose of damaged goods until insurer or surveyor instructs; improper disposal can void claims.

- Use a recognized surveyor: For high-value claims, appointing a reputable surveyor (and following their instructions) adds credibility.

- Understand salvage & repair options: Insurers may prefer repair or salvage over replacement; document repair quotes and costs carefully.

For a practical walkthrough of these steps, see the Step-by-Step Guide to Filing a Marine Cargo Insurance Claim. That guide shows the typical sequence and the documentation that underwriters expect.

Preparing to make a successful claim (documentation & timing)

- Confirm product declaration (batteries? ESD-sensitive? temperature limits?)

- Select ICC A / All-Risks cover (or negotiated equivalent) and verify declared value includes freight & duties

- Add temperature deviation or battery-specific endorsements if required

- Ensure pre-shipment photos, humidity indicators, and data loggers are in place

- Choose experienced carrier and reputable freight forwarder with claims support

- Prepare contact list: insurer claims desk, surveyor, forwarder claims officer

Premium management — how to reduce cost without increasing risk

Electronics shippers can manage premiums by demonstrating strong risk controls: good packing, proven carriers, fewer claims, and using approved forwarders. For in-depth tips on lowering premium cost while maintaining cover quality, review our practical ideas in Tips to Reduce Your Marine Cargo Insurance Premium. Volume-based annual programs also often produce better pricing and more flexible wording than ad-hoc single-voyage purchases.

Final note — insurance + operations = resilience

Marine insurance is a financial backstop — but it is most effective when paired with disciplined operational controls. Electronics shippers protect margins and reputation not by buying the cheapest policy, but by combining the right policy wording, appropriate endorsements, and tight logistics execution so that losses are minimized and, when they occur, claims are straightforward to prove.

If you would like, we can review your next electronics shipment and provide a tailored risk checklist, recommend precise policy endorsements (batteries, temperature, theft), and prepare a documentation pack to maximise claim acceptance. Contact us for a no-obligation shipment risk review and insurance quote.

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!