What is CIF? Cost, Insurance and Freight Shipping

CIF stands for Cost, Insurance, and Freight and is an Incoterm rule for international trade, meaning the seller is responsible for paying the costs of the goods, insurance, and freight to a specific port of destination. While the seller covers these costs, the risk of loss or damage transfers to the buyer once the goods are loaded on the vessel, though the seller provides minimum insurance coverage for the journey. This term is applicable only for sea and inland waterway transport.

As a leading Malaysian freight forwarder, TNSLOG specializes in seamless sea freight solutions, helping businesses navigate complex shipping terms like CIF (Cost, Insurance, and Freight). This comprehensive guide breaks down CIF shipping terms, their responsibilities, pros and cons, and real-world applications—making it easier for you to make informed decisions in your global supply chain.

What is CIF? The Basics of CIF Incoterms

Defined by the International Chamber of Commerce (ICC) in Incoterms 2020, CIF is ideal for sea or inland waterway transport. Think of it as the seller providing a “package deal” up to the buyer’s port: they handle production, export clearance, main carriage, and basic insurance. However, the risk transfers to the buyer as soon as the goods pass the ship’s rail—meaning if damage occurs during transit, the buyer claims under the seller-provided insurance.

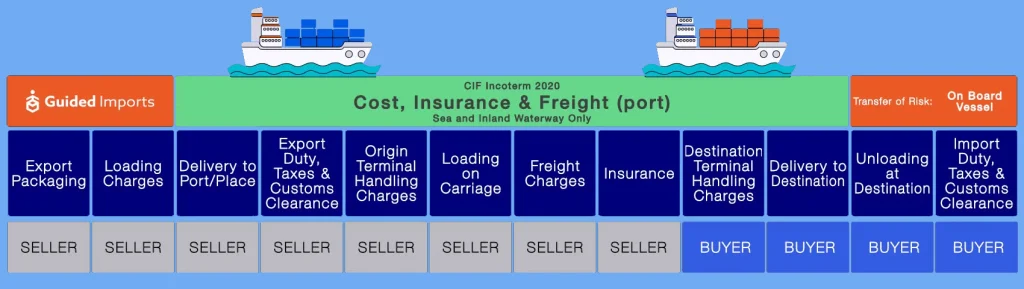

Seller and Buyer Responsibilities Under CIF Incoterms

CIF Incoterms clearly divide duties between seller and buyer, focusing on cost responsibility, risk transfer, and title passage. Here’s a straightforward breakdown to help you visualize:

Seller's Responsibilities in CIF Shipping

- Goods Preparation: Manufacture, package, and mark the goods to meet contract specs.

- Export Handling: Arrange inland transport to the loading port, complete export clearance, and load goods onto the vessel.

- Freight and Insurance: Pay ocean freight to the named destination port and procure minimum insurance coverage (typically 110% of invoice value against all risks).

- Documentation: Deliver key papers like the commercial invoice, insurance certificate, and negotiable bill of lading to the buyer.

Buyer's Responsibilities in CIF Incoterms

- Port and Beyond: Unload goods at the destination port, handle import clearance, pay duties/taxes, and arrange final delivery.

- Risk Management: Bear transit risks post-loading and claim via the seller’s insurance if needed.

- Additional Coverage: Often buy extra insurance, as CIF’s minimum policy may not cover full losses.

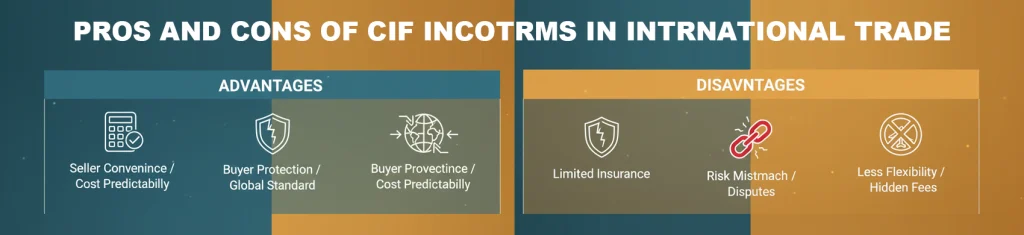

Pros and Cons of Using CIF Incoterms in International Trade

CIF shipping terms offer balance but aren’t one-size-fits-all. Weigh these advantages and drawbacks for your sea freight needs:

Advantages of CIF Incoterms

- Seller Convenience: Exporters (like Malaysian firms) can bundle costs into one quote, simplifying pricing for international trade.

- Buyer Protection: Built-in insurance reduces immediate worries, ideal for importers new to sea freight.

- Cost Predictability: Fixed freight and insurance upfront aids budgeting in volatile markets.

- Global Standard: Widely used for commodities like Malaysia’s palm oil exports, ensuring compatibility in CIF Incoterms applications.

Disadvantages of CIF Incoterms

- Limited Insurance: The minimum coverage often falls short—buyers may face out-of-pocket expenses for full protection.

- Risk Mismatch: Seller pays freight but buyer bears transit risk, potentially leading to disputes if goods arrive damaged.

- Less Flexibility: Best for sea freight; not suited for air or multimodal transport.Hidden Fees: Unloading costs at destination can surprise unprepared buyers.

Overall, CIF Incoterms shine for experienced traders seeking efficiency in international trade, but consult a freight forwarder like TNSLOG for tailored advice.

CIF vs. Other Incoterms: A Quick Comparison Table

| Incoterm | Transport Mode | Seller's Key Duties | Buyer's Main Costs/Risks | Best For |

|---|---|---|---|---|

| CIF | Sea/Inland Waterway | Goods cost + freight + min. insurance to destination port | Unloading, import clearance, full risks post-loading | Sellers providing turnkey sea freight |

| FOB | Sea/Inland Waterway | Delivery to origin port loading | Freight, insurance, all post-loading risks | Buyers controlling transport |

| CFR | Sea/Inland Waterway | Goods cost + freight to destination | Insurance, unloading, import | Similar to CIF but no insurance |

| EXW | Any | Factory handover only | All transport, clearance, risks | Minimal seller involvement |

| DDP | Any | Full delivery + duties to buyer | Unloading only | Hands-off for buyers |

Mastering CIF Incoterms unlocks efficiency in sea freight and international trade, balancing costs, risks, and responsibilities. From basic insurance to port delivery, it’s a go-to for streamlined operations. At TNSLOG, Malaysia’s reliable freight forwarder with over 20 years in the game, we offer end-to-end CIF support—from quoting to tracking. Ready to optimize your next shipment? Reach out at network1@tnslog.com.my for a free consultation.

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!