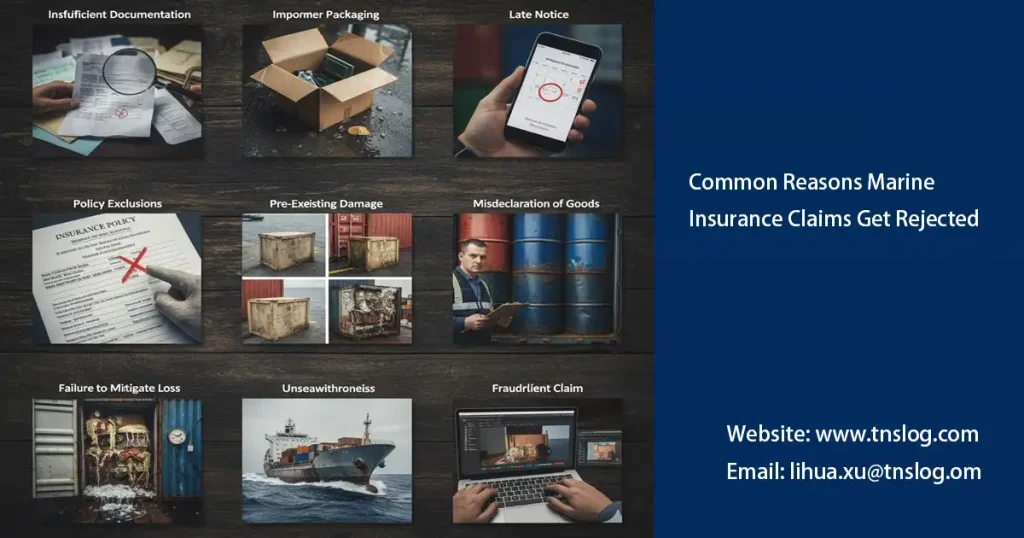

Common Reasons Marine Insurance Claims Get Rejected

Have you ever filed a marine insurance claim only to find it unexpectedly rejected? Many shippers and exporters face this frustrating situation—believing their cargo was fully protected, only to discover that small oversights, unclear documentation, or policy misunderstandings led to denial of coverage. Understanding the common reasons marine insurance claims get rejected is crucial to safeguarding your financial interests and avoiding costly disputes. In this article, we’ll break down the most frequent mistakes and show you how to prevent them before your next shipment.

Incomplete Documentation

Hands down, incomplete documentation is the number one reason marine insurance claims get rejected, accounting for nearly 40% of denials in ASEAN routes. Insurers can’t verify losses without a full paper trail, leaving adjusters no choice but to flag your file for “insufficient evidence.”

Common Culprits:

- Missing Core Papers: No bill of lading? No commercial invoice? Claims evaporate. A Penang palm oil exporter lost RM200,000 last monsoon season because their packing list was AWOL—insurers dismissed the water damage as unproven.

- Vague Descriptions: Generic “cargo damaged” notes won’t cut it. Detail the peril (e.g., “container breach from rough seas”) with timestamps.

- Digital Gaps: Scanned docs that are blurry or unorganized? Expect delays or outright rejections in fast-paced marine cargo insurance reviews.

Real Impact: In our audits, fixing doc holes upfront boosts approval odds by 60%. For a foolproof checklist, dive into our What Documents You Need for a Successful Claim—it’ll transform your submissions from shaky to solid.

Late Notification

Time is the silent killer in marine insurance claim denials. Policies demand notice within 24-72 hours of discovering issues—miss it, and your claim’s dead in the water, rejected for “breach of condition.” We’ve seen this spike during peak seasons, when port congestion in Singapore or Jakarta buries alerts.

Why It Happens:

- Incident Overload: Crews spot pilferage mid-voyage but wait till discharge to report, breaching the “utmost good faith” principle.

- Communication Breakdowns: Satellite lags or email black holes delay alerts. A recent case: A KL textile importer notified Day 4 after container tampering—claim rejected, costing RM150,000.

- Misunderstood Timelines: Newbies confuse “discovery” with “formal survey,” inviting automatic denials.

Data Point: Per the International Union of Marine Insurance, late notifications cause 25% of global rejections—up 15% post-2023 supply chain snarls.

Pro Tip: Set auto-reminders in your voyage log. As your Malaysia-based partner, we offer 24/7 claim hotlines to log issues instantly, slashing rejection risks.

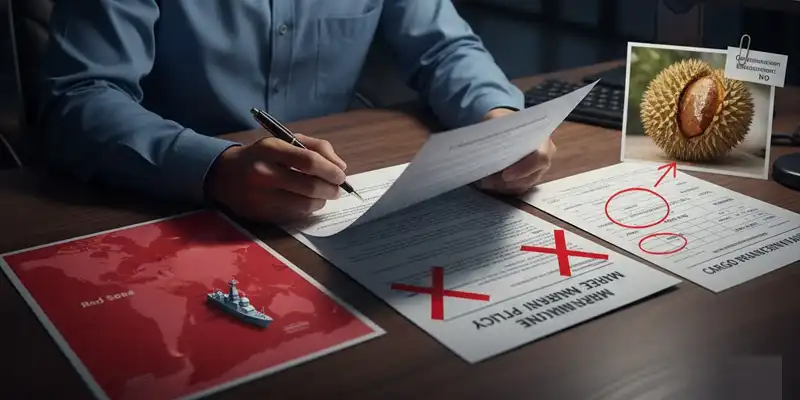

Excluded Risks or Improper Coverage

Ever filed a marine insurance claim only to hear “not covered”? Excluded risks top the list for shipping claim rejections, hitting 20% of cases. Policies are picky—standard “all risks” clauses still sideline war zones, inherent vice, or unseaworthiness.

Key Triggers:

- Policy Mismatches: Insuring for “named perils” but suffering from an “all risks” outlier like gradual deterioration? Denied. Our firm caught this for a Johor electronics shipper eyeing Red Sea routes—upgraded coverage averted disaster.

- Underinsurance Traps: Valuing cargo at cost price ignores profits or freight; claims get partial payouts or full rejections.

- Endorsement Oversights: Skipping add-ons for strikes or contamination? Common in perishables like Malaysian durians, where spoilage claims flop without extras.

Insight: With geopolitical tensions rising in 2025, exclusions for conflict zones are rejecting 10% more claims yearly (Marine Insurance Act insights).

Pro Tip: Audit policies pre-shipment. Link your coverage to Top Causes of Cargo Damage in Ocean Shipping for proactive peril-proofing—our free tool flags gaps.

Non-Compliant Packaging

Shoddy packaging isn’t just a damage magnet—it’s a fast track to marine cargo insurance claim rejections under “negligence” clauses. Insurers reject 15% of filings when goods arrive battered due to improper stowage, arguing the shipper shares blame.

Frequent Fumbles:

- Inadequate Securing: Loose pallets in containers lead to shifts; a Port Klang coffee exporter’s claim tanked after beans spilled from unsecured crates.

- Material Mismatches: Using non-waterproof boxes for tropical routes? Expect “inherent defect” denials, especially in Malaysia’s humid climes.

- Labeling Lapses: Faded hazmat tags or missing “fragile” markers void coverage for mishandled items.

Case Study: We salvaged a RM300,000 rubber shipment by proving compliant ISPM-15 fumigation—non-compliance would’ve sealed rejection.

Pro Tip: Certify packaging via MIMET standards. Our warehousing team in Penang stress-tests loads, ensuring your claims sail through.

Tips to Avoid Rejection

Dodging marine insurance claims rejected doesn’t require wizardry—just diligence. Here’s our battle-tested playbook to fortify your shipping insurance claims:

- Pre-Voyage Drills: Run mock claims with checklists; simulate notifications to catch leaks early.

- Partner Wisely: Lean on local experts—our Malaysia network integrates surveyors for instant post-incident support, cutting denial rates by 70%.

- Tech Boost: Use apps like CargoGuard for real-time logging; AI flags doc incompletes before submission.

- Review Annually: Update policies for emerging risks like cyber threats to vessels—stagnant coverage invites rejections.

- Document Everything: From loading photos to expense receipts, over-prepare to under-reject.

By tackling these common reasons for marine insurance claim denials head-on, you’ll reclaim control over your bottom line. Remember, 80% of rejections are fixable with foresight.

Conclusion

At our Malaysia freight forwarding hub, we’ve turned rejection horror stories into payout triumphs for ASEAN traders. Got a pending marine cargo claim or upcoming voyage? Hit us up for a no-obligation audit—let’s chat routes, risks, and reimbursements. Email lihua.xu@tnslog.com or call +60166009972 today.

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!