The Role of Insurance in International Shipping

In today’s fast-paced global trade, where international shipping handles over 90% of goods movement, risks like storms, piracy, and geopolitical tensions are on the rise. The role of insurance in international shipping goes far beyond simple financial payouts—it’s your risk barrier, compliance shield, and foundation for trade confidence. As a Malaysian freight forwarder, we’ve seen marine insurance turn potential disasters into manageable hiccups for shipments from Port Klang’s palm oil exports to Europe. Whether you’re an exporter or importer, grasping how international shipping insurance bolsters your supply chain builds real resilience. Keep reading to uncover the role of insurance in international shipping and why it’s a must-have for 2025 trade.

The Importance of Insurance in Global Trade

International shipping insurance acts as the unseen backbone of global trade. In 2025, with escalating geopolitical strains and climate-driven risks, its strategic edge shines brighter than ever. Malaysia, as Southeast Asia’s logistics hub, boasts a marine cargo insurance market valued at 14.56 billion MYR in 2025, projected to grow at a CAGR of 8.05% from 2026 onward—this underscores insurance’s pivotal place in trade.

Financial Protection

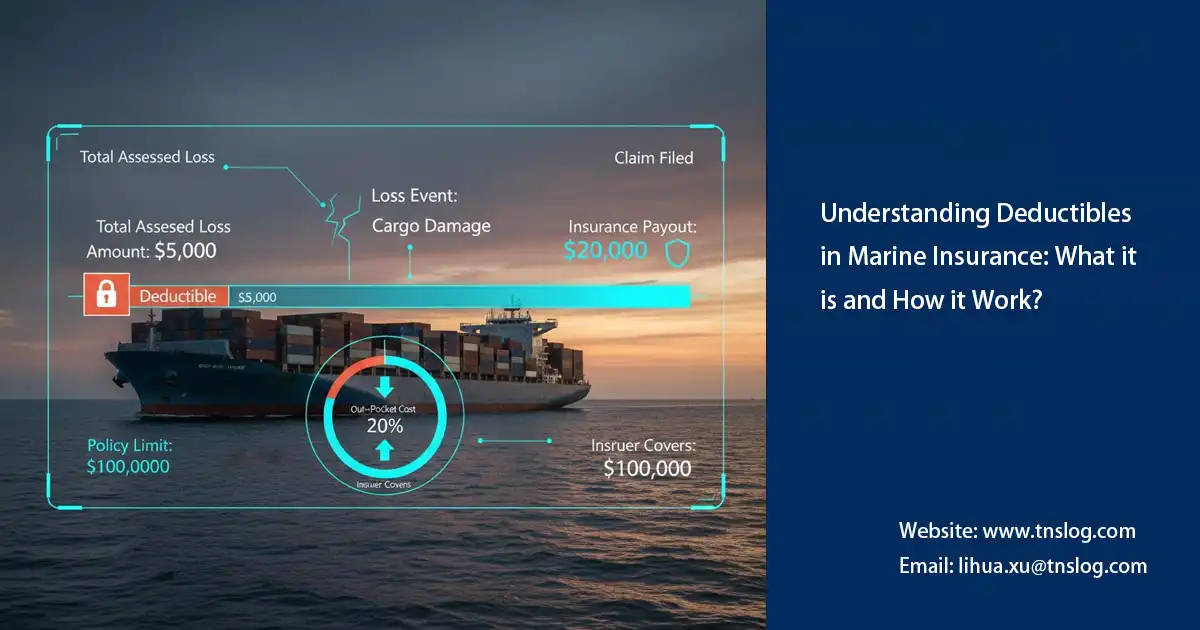

The role of insurance in international shipping starts with rock-solid financial safeguards. When cargo hits snags—like conflicts in the Red Sea or storms in the South China Sea—losses can soar into millions. Marine insurance delivers quick reimbursements, covering everything from total losses to partial damage, often up to 110% of cargo value. Picture a Malaysian electronics shipment battered by a Pacific typhoon: insurance steps in fast with repair or replacement funds, keeping your cash flow steady.

According to Allianz Commercial’s 2025 Safety and Shipping Review, global shipping loss trends reveal that uninsured cargo racks up 20–30% extra costs for businesses. In Malaysia, the general insurance market hit a 4% growth in the first half of 2025, on track for $5.5 billion annually with a 6.6% CAGR through 2029—marine segments play a big role, helping exporters like palm oil producers weather market swings.

Legal Compliance

Legal compliance rounds out another vital role of insurance in international shipping. Incoterms like CIF demand seller-provided coverage, or deals fall apart. EU and U.S. carriage laws enforce minimum protections, with violations risking fines or disputes. Wondering how insurance stacks up against carrier liability? Dive into our guide, Marine Insurance vs Carrier Liability: Key Differences, to bust common myths.

In Malaysia, the Contracts Act and customs rules amp up these needs—our freight services often bundle insurance docs to meet letter-of-credit demands from financing banks. As 2025 sustainable trade rules ramp up, insurance must now tackle carbon-related risks too, keeping your operations fully compliant.

How Insurance Supports Risk Management

Mitigating Natural and Human Risks

From hurricanes to piracy or strikes, international shipping faces a barrage of threats. Here, the role of insurance in international shipping shines through targeted Institute Cargo Clauses (ICC): All Risks (ICC A) guards against mishaps, while war extensions handle political hotspots. Curious about top culprits behind cargo damage at sea? Check out Top Causes of Cargo Damage in Ocean Shipping for proactive tips.

Take 2025: Asia fueled 60% of worldwide cargo insurance growth last year, and Malaysian exporters can layer on SRCC (strikes, riots, civil commotions) clauses to shield Penang-bound shipments to the Middle East from disruptions. Our team uses risk tools to slash potential hits below 1%.

Ensuring Business Continuity

Business continuity? That’s international shipping insurance at its best. Post-incident, it funds salvage, rerouting, and legal fees to keep chains humming. Envision a container vessel from Port Klang stalled by engine trouble—insurance covers alternate routes, hitting deadlines without a hitch.

Malaysia’s Insurance Highlights 2025 report stresses how insurance boosts maritime safety and reliability. With the general insurance market eyeing $7.2 billion by 2029, it’s a lifeline for export-reliant SMEs, dodging one-off hits that could tank a full year.

Insurance as a Tool for Trade Confidence

Buyer and Seller Assurance

Buyers get delivery peace of mind, cutting rejection odds; sellers lock in payments, dodging credit woes. Under CIF, seller coverage shifts risks to the buyer’s port, fostering mutual security.

In Malaysia, our one-stop insurance setups have surged war-risk demand in 2025, helping textile clients nail European deals.

Strengthening Trade Relationships

Solid relationships thrive on trust, and international shipping insurance cements that by setting reliable expectations. Insured firms snag easier financing like bank guarantees and draw top partners. Malaysia’s shipping services market surges with digital insurance— we’ve watched clients leverage it to tap African frontiers.

Conclusion

In short, the role of insurance in international shipping is multifaceted: it shields finances, nails compliance, tames risks, and fortifies trade trust. In 2025’s risk-riddled seas, skipping insurance is a gamble—global trade leans on shipping for 90%, and one cargo snag can snowball into chaos. Port KlangNo shipment should sail uninsured—because in international shipping, insurance isn’t an expense; it’s an investment. Ready to protect your trade? We’re here for a free consult.

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!