MALAYSIA CUSTOMS CLEARANCE SERVICES

own our custom clearance license (as know malaysia very hard to get own custom clearance license)

- have custom team and familiar with Malaysia customs policies

- help you handle all customs clearance documents

- Fast clear your cargo from custom

- Professional service team 7*24 online support

- Capable of handling customs clearance issues for difference problem

Get a free malaysia customs clearance inquiry now

Prepare customs declaration documents-malaysia customs clearance services

Declaration to Customs-malaysia customs clearance services

Customs inspection of goods- malaysia customs clearance services

Tax payment and release of goods- malaysia customs clearance services

Common customs clearance issues and solutions-malaysia customs clearance services

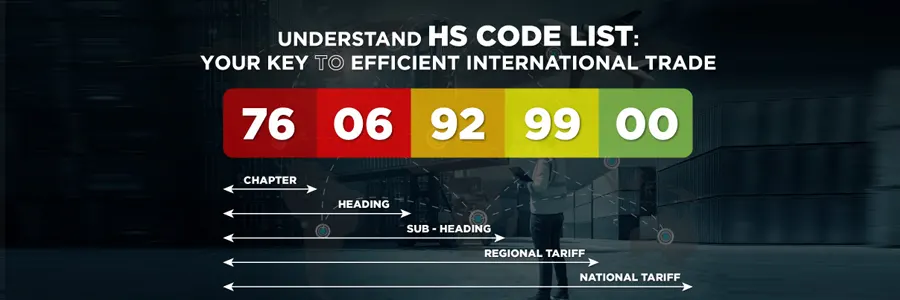

Common customs coding errors mainly include inaccurate or incomplete product descriptions and incorrect product classification. In addition, there may be certain differences in the customs codes of different countries, which can also lead to errors in the customs codes filled in when declaring and clearing goods.

2. Inconsistent declaration of customs clearance goods

3. Incomplete licenses and other documents

4. Other customs clearance issues

How long does it take to clear customs from Malaysia ?

The time for customs clearance from Malaysia depends on various factors, including the name, quantity, import and export methods, transportation methods, and regulatory requirements of Malaysian customs. The required customs clearance time for different goods varies from a few days to several weeks.

According to official statistics from the Royal Malaysian Customs, the average clearance time for Malaysian goods in 2022 was 7.2 days, with an average clearance time of 4.5 days for air cargo and 8.9 days for sea freight.

If you want to accelerate the customs clearance speed of your goods, you can improve it through the following methods:

- Prepare customs declaration documents in advance to ensure completeness and accuracy of the documents

- Understand the regulatory requirements of Malaysian customs and prepare in advance

- Choose a reputable customs declaration agent

- Using an electronic declaration system

- Advance appointment for inspection

For the following specific goods, Malaysian customs may implement stricter inspections, which may result in longer clearance times. You need to adjust the shipping schedule of the goods appropriately to avoid delays in sea or air transportation.

- Animals, plants and their products

- Food, medicine, cosmetics, etc

- hazardous chemicals

- Endangered flora and fauna

- Intellectual Property Infringement Products

- Sensitive items

What are the tariffs in Malaysia

According to Malaysian customs regulations, the tariff rate for imported goods is generally between 0% and 30%. Among them, the tariff rates for most industrial manufactured products are between 5% and 20%, while the tariff rates for agricultural products and food are relatively high, up to 50%.

Malaysia provides preferential tariff treatment for imported goods from partner countries under the Free Trade Agreement (FTA). According to specific regulations of different FTAs, preferential tariff rates can be 0% or lower.

The following are some common tariff rates for imported goods from Malaysia:

- Electronic products: 5% -20%

- Mechanical equipment: 5% -15%

- Textiles: 10% -20%

- Chemicals: 5% -20%

- Food: 10% -50%

Special Sea freight routes

- From Port Klang to South Africa

- From Penang to South America

- From Johor to Africa

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!