How to Choose the Right Freight Forwarder for Insured Shipments?

Choosing a freight forwarder is one of the most critical decisions for any exporter or importer. But when your cargo is insured, the decision becomes even more important. A freight forwarder who understands insurance—not just logistics—can help you avoid losses, streamline claims, and ensure every shipment is properly protected. This article explores what truly matters when choosing the right freight forwarder for insured shipments and how to identify one that adds real value beyond basic transportation.

Why Insurance-Integrated Freight Forwarding Matters?

In international shipping, risks are everywhere—rough seas, mishandling, theft, delays, or weather-related damage. While marine cargo insurance is designed to cover these risks, the efficiency and accuracy of your claim often depend on your freight forwarder’s expertise.

An insurance-integrated freight forwarder acts as your first line of defense. They don’t just move cargo; they ensure that every shipment is properly documented, insured under the right policy type, and compliant with all claim requirements. This minimizes the chance of disputes and speeds up the claim process.

For a deeper understanding of how insurers differ in coverage and rates, you can read “Comparing Rates Among Top Marine Insurance Providers”

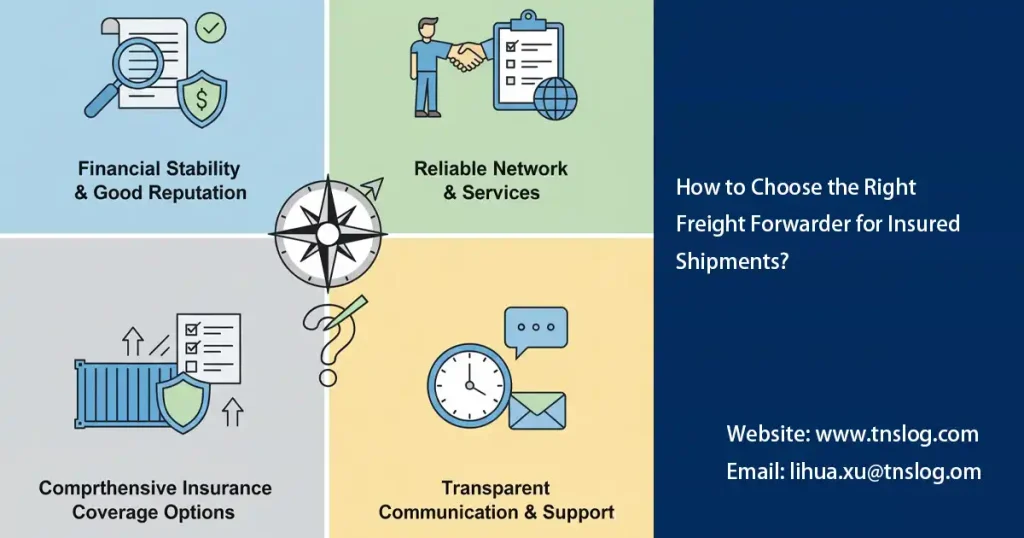

Key Criteria When Selecting a Freight Forwarder for Insured Shipments

1. Insurance Expertise and Policy Knowledge

A qualified freight forwarder should have a solid understanding of marine cargo insurance terms and practices. They should be able to recommend the right policy type—whether All Risks, With Particular Average (WPA), or Free from Particular Average (FPA)—based on your cargo type and route.

For example, perishable goods or electronics require broader “All Risks” coverage, while heavy machinery may only need partial coverage under WPA. A knowledgeable forwarder will not only advise you on these distinctions but also ensure that your policy clearly defines coverage limits and claim requirements.

Forwarders who understand policy details can also guide you through complex claim situations, helping you prepare documentation correctly and avoid rejection. You can learn more about this topic in “Should You Buy Marine Insurance Through Your Freight Forwarder?”

2. Accreditation, Compliance, and Credibility

Always verify whether your freight forwarder is accredited by recognized industry bodies such as FIATA, IATA, or ISO 9001. Accreditation ensures that they follow standardized processes and ethical practices, particularly when handling insured shipments.

Additionally, confirm that the forwarder partners with licensed insurance brokers or underwriters. This guarantees that the policy you purchase is legitimate and backed by reputable insurers capable of paying valid claims.

3. Claims Handling Efficiency and Support

Filing a claim can be stressful, especially when dealing with multiple stakeholders. A professional freight forwarder simplifies this process by acting as your advocate throughout the claim.

They help you gather the required documentation—like the Bill of Lading, Packing List, Commercial Invoice, and Insurance Certificate—and submit it efficiently. A forwarder experienced in claims management can often reduce settlement time from months to weeks.

Look for forwarders that offer post-shipment support, real-time claim tracking, and clear communication during the entire claim lifecycle.

4. Transparency in Coverage and Exclusions

Before purchasing insurance through your freight forwarder, make sure they provide full transparency regarding coverage terms and exclusions. Some policies may not cover losses due to improper packing, inherent defects, or delays caused by customs inspections.

A reliable forwarder will present these details clearly in writing, ensuring you fully understand what is—and isn’t—covered. This transparency protects you from unpleasant surprises when filing a claim and builds long-term trust.

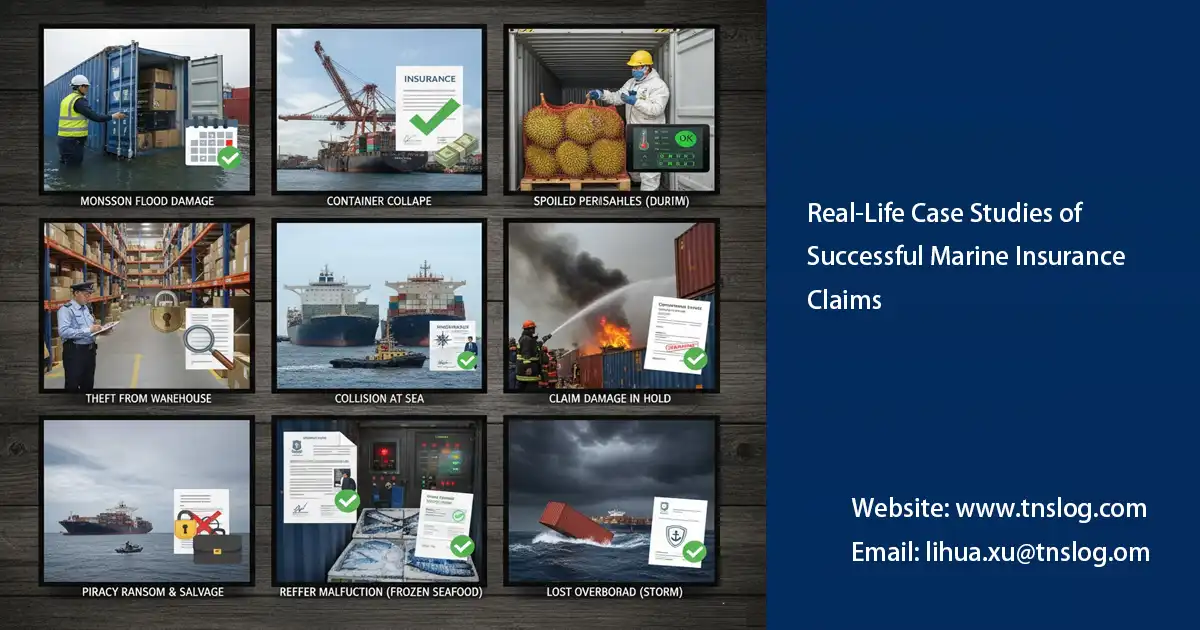

5. Customer Reputation and Case Experience

Customer feedback and case studies can reveal a lot about how a freight forwarder performs under real-world pressure. Check for documented success stories showing how the forwarder helped clients resolve claims quickly and recover their cargo value.

You can research testimonials on LinkedIn, Google Reviews, or logistics industry forums. A forwarder with proven experience in insured shipments and positive claim outcomes is far more likely to deliver consistent reliability.

6. Value-Added Risk Management Services

The best freight forwarders go beyond selling insurance—they proactively reduce the need for claims. They may offer:

- Professional packing and securing guidance

- Real-time cargo tracking systems

- Pre-shipment risk assessment reports

- Advisory on route-specific risk zones

These added services enhance overall cargo safety, reduce losses, and provide peace of mind. They also demonstrate that your forwarder is genuinely invested in your supply chain’s resilience, not just in moving your goods from point A to point B.

Questions to Ask Before Choosing Your Freight Forwarder

Before signing any agreement, take time to ask questions like:

- Can you provide a sample of your insurance policy?

- What specific coverage does your freight insurance include?

- How are insurance premiums calculated?

- Who assists with claim submission and follow-up?

- Can you customize insurance for my cargo type or trade lane?

These questions not only clarify the forwarder’s expertise but also help you gauge their commitment to transparency and customer support.

Conclusion

When choosing a freight forwarder, don’t treat insurance as an optional service—it’s an essential part of global logistics risk management. The right freight forwarder will protect your cargo, simplify the claim process, and provide complete visibility from pickup to delivery.

Partner with a freight forwarder that combines logistics expertise with robust insurance support. Contact us today to discover how our customized solutions can safeguard your cargo and streamline your next insured shipment.

You may also be interested in

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!