How the Currency Adjustment Factor (CAF) Impacts Shipping Costs from Malaysia?

You may not be familiar with the currency adjustment factor (CAF), but as an exporter, you’ve undoubtedly paid the price for its fluctuations. From increased freight rates caused by detours around the Red Sea, to the impact of US-China tariffs, to volatile exchange rates, these factors have caused CAF to surge your total freight costs by 5-10%, significantly eroding your profit margins.

According to the latest data from Bank Negara Malaysia, the US dollar to Malaysian ringgit (USD/MYR) exchange rate will fall from 4.72 to 4.48 in the first half of 2025, leading to an average CAF increase of 2-3% on routes from Southeast Asia to North America. For key Malaysian exports like palm oil and electronics, this could mean additional costs of up to $200 per 40HQ container.

TNSLOG SERVICES, a professional freight forwarder specializing in Malaysia-global routes, has helped hundreds of companies mitigate CAF risks. This article will provide an in-depth analysis of the CAF mechanism, calculation logic, real-world cases, and trends for Q4 2025, helping you accurately control ocean freight costs and maintain export competitiveness.

What Is Currency Adjustment Factor (CAF) ?

The Currency Adjustment Factor (CAF) is a surcharge imposed by shipping companies to hedge against exchange rate fluctuations. In international trade dominated by the US dollar, shipping companies typically quote prices in USD, but actual operating costs (such as Malaysian port fees and fuel procurement in Southeast Asia) are often settled in local currencies. When the US dollar depreciates, the dollar equivalent of these local expenses increases, forcing carriers to transfer the difference through the CAF.

Calculating CAF: Formula, Examples, and Influencing Factors

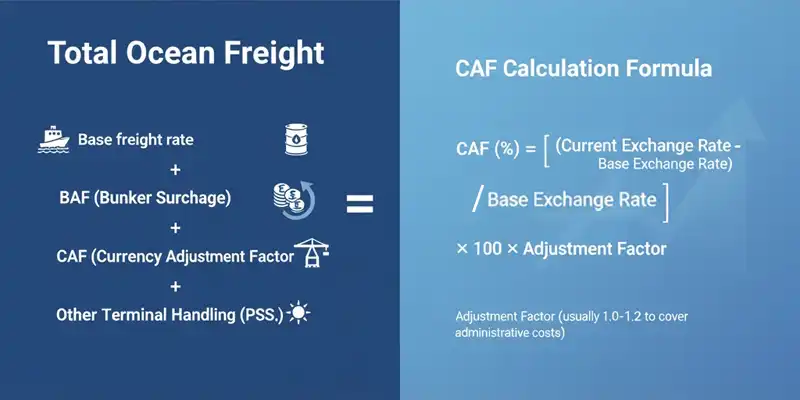

A standard ocean freight quote structure is:

Total freight = Base freight rate + BAF (Bunker Surcharge) + CAF + THC (Terminal Handling Charge) + Other charges (such as PSS Peak Season Fee).

The CAF calculation formula is typically:

CAF (%) = [(Current Exchange Rate – Base Exchange Rate) / Base Exchange Rate] × 100 × Adjustment Factor (usually 1.0-1.2 to cover administrative costs)

Practical CAF Calculation Example

Assume the shipping company’s base exchange rate is 1 USD = 4.50 MYR (commonly used in early 2025 contracts).

- Scenario 1: The US dollar depreciates. The current exchange rate falls to 4.22 MYR (real-time rate as of October 10, 2025). Deviation = (4.22 – 4.50) / 4.50 = -6.22%. The CAF increases by approximately 6-7% (adjustment factor 1.1). This results in a total CAF increase from 60 USD to 132 USD for a base rate of 2,000 USD, an additional cost of 72 USD.

- Scenario 2: The US dollar strengthens. The exchange rate rises to 4.60 MYR, resulting in a deviation of +2.22% and a CAF decrease of approximately 2%, resulting in a small cost savings.

How CAF erodes palm oil trade profits (Malaysia's real export case)

TNSLOG recently handled an order for Malaysian palm oil products exported to the US East Coast, a perfect example of the “hidden impact” of CAF.

- Route: Penang Port → New York Port, 40HQ container.

- Contract Details: Fixed USD quotation for three months, base rate of USD 1,800, initial CAF of 4% (base exchange rate 4.50 MYR).

- Exchange Rate Fluctuation: 4.50 MYR at contract signing, falling to 4.22 MYR two months later (a 6.2% depreciation).

- CAF Adjustment: The shipping company increased the CAF to 8.5%, resulting in an additional cost of approximately USD 81 per container.

- Total Impact: Exporters’ profit margins dropped from 15% to 11%, as CIF terms fully cover the cost for the seller. During the same period, global palm oil prices remained stable, but rising freight rates offset two-thirds of the exchange rate gains.

Similar cases are expected to occur frequently in 2025: Malaysia’s total exports to the US are projected to grow by only 4%, with CAF contributing approximately 1% of this “hidden cost.” Through TNSLOG’s fixed CAF agreement, this customer saved 15% on subsequent orders.

5 Practical Strategies: TNSLOG Helps You Lock Down CAF Risk

Don’t let CAF become a stumbling block for exports. TNSLOG offers customized solutions to help you mitigate the risk of increased export costs due to CAF.

- Fixed CAF Agreements: Lock in a fixed quarterly rate (such as offered by MSC or Maersk). Suitable for large-volume exports. By 2025, we helped clients save an average of 8% in fluctuating costs.

- Split Shipments and Dynamic Quotes: Split large orders and review exchange rates monthly to avoid concentrated increases. Tools: TNSLOG’s real-time freight rate tracking app.

- Multi-Currency Settlement Optimization: Switch to MYR or EUR for settlement of ASEAN/Middle East trades to reduce reliance on the US dollar. Suitable for palm oil routes to Indonesia.

- Monitor Bulletins and Trend Reports: Subscribe to TNSLOG’s monthly report covering CAF changes on Malaysia-US, Europe, and Australia routes. Q4 forecasts a 2% upside.

- Overall Freight Rate Restructuring: Collaborate with freight forwarders to balance the BAF/CAF ratio and leverage capacity from new vessels entering service in 2025.

Outlook for CAF Trends on Malaysia Routes in Q4 2025

Entering Q4, the USD/MYR exchange rate is expected to remain in the 4.20-4.25 range, weighed down by Federal Reserve policy and slowing global growth. CAF rates on Southeast Asia-North America routes may increase by 1.5-2.5% as tariffs increase local costs. Routes to Europe will see a more modest increase (0.5-1.5%), benefiting from the stability of the Euro.

| Route | Current CAF (%) | Q4 Estimated Change | Key Drivers |

|---|---|---|---|

| Malaysia - USA | 6–8 | +1.5–2.5% | USD appreciation + tariffs |

| Malaysia - Europe | 4–6 | +0.5–1.5% | Red Sea route relief |

| Malaysia - Middle East | 3–5 | ±0–1% | Regional stability |

Conclusion

While CAF is a form of “currency insurance” for shipping, it presents a double challenge for Malaysian exports. With trade barriers increasing by 2025, understanding and managing CAF will become a core competitive advantage for Malaysian exporters.

TNSLOG SERVICES invites you to request a free consultation: receive a personalized CAF risk assessment, or download our “2025 Ocean Freight Guide.” Contact: lihua.xu@tnslog.com | +6016-600 9972

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!