How Freight Forwarders Handle Cargo Insurance Claims?

In international trade, cargo insurance claims are often more complicated than most shippers expect. Many exporters and importers only realize how complex the process is when their goods are damaged or lost. Missing documents, unclear liability, and poor communication with insurers frequently lead to delays or even claim rejections.

This is where freight forwarders play a crucial role. An experienced forwarder not only ensures smooth shipping operations but also provides professional support throughout the insurance claim process, helping clients secure fair and timely compensation.

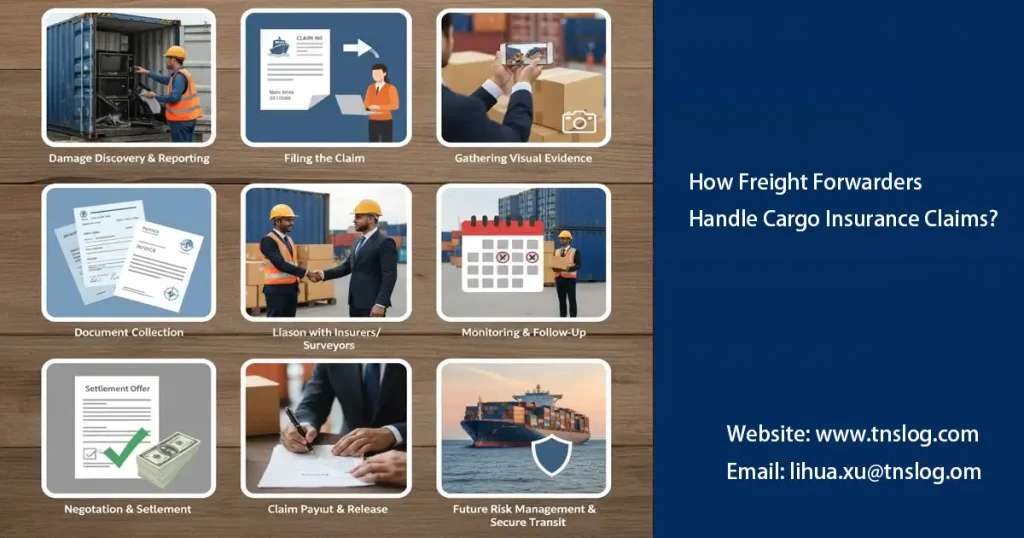

Role of Freight Forwarder in Claims

Freight forwarders act as both coordinators and information hubs in the cargo insurance claim process.

When cargo is damaged or lost, the forwarder immediately assists the client in initiating the claim—by notifying the insurer, arranging inspections, and gathering necessary evidence.

With a deep understanding of transport logistics, forwarders can quickly identify at which stage the damage occurred and provide evidence to support the client’s position, reducing the risk of rejection due to lack of documentation.

Many shippers often ask: Should I buy marine insurance through my freight forwarder?

In fact, the answer is closely related to how efficiently your claim can be handled. Buying insurance through your forwarder often ensures smoother service and faster communication (see Should You Buy Marine Insurance Through Your Freight Forwarder?)

Documents and Coordination

In most cases, the problem in cargo insurance claims is not rejection—but incomplete documentation.

A standard claim submission usually requires the following documents:

- Bill of Lading

- Commercial Invoice and Packing List

- Copy of Insurance Certificate

- Survey Report

- Photos and Damage List

The freight forwarder’s role here is to consolidate and verify all documents, ensuring all details—such as consignee name and shipment dates—match perfectly. Even minor discrepancies can delay or void a claim. Moreover, freight forwarders maintain close communication with insurers, surveyors, and carriers, coordinating all parties to speed up resolution.

Expedite the Claim Process

Time is a critical factor in every insurance claim. Through years of experience, freight forwarders have developed efficient systems to expedite the claim process:

- Prompt Notification – The forwarder immediately informs the insurer and carrier once cargo damage occurs.

- Pre-prepared Documentation Templates – Standardized claim templates speed up submission.

- Claim Investigation Support – The forwarder provides tracking logs, CCTV footage, and loading records to support your claim.

- Professional Filing Guidance – Their familiarity with insurer protocols helps clients avoid common mistakes.

For a detailed explanation of each step, refer to Step-by-Step Guide to Filing a Marine Cargo Insurance Claim

Benefits of Using a Forwarder

Using a freight forwarder to handle cargo insurance claims offers multiple advantages:

- Professional Expertise – Forwarders understand insurance terminology and processes, minimizing communication errors.

- Time and Resource Efficiency – They can handle documentation and follow-ups, saving clients significant time.

- Higher Claim Success Rate – Proper documentation and strong evidence improve approval rates.

- Preventive Support – Forwarders can advise on preventive measures to reduce risk before shipment.

If your shipment has suffered damage or you’re struggling to manage the claim process, contact our professional team for comprehensive support. We offer one-stop marine insurance and claims handling solutions to protect your cargo and your business interests.

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!