The Difference Between Institute Cargo Clauses A, B and C

Have you ever stared at your marine cargo insurance policy, wondering why a storm-damaged shipment from Port Klang to Rotterdam was denied coverage under Clause C but passed under Clause A? In the turbulent seas of trade in 2025—where Asia-Pacific claims are expected to rise 12% due to Red Sea diversions and a surge in typhoons—this confusion could cost Malaysian exporters thousands of dollars in uncovered losses.

As a seasoned freight forwarder connecting Johor palm oil giants and Penang tech shippers to global markets, we’ve deciphered the differences between Institute Cargo Clauses A, B, and C for countless clients. These standard Lloyd’s of London clauses define your coverage, exclusions, and premiums. Choose the right one, and you’re protected; choose the wrong one, and your risk multiplies. Let’s break it down so you can find the perfect terms for your next voyage. To understand how these clauses apply to different types of insurance, please review our article Overview of the Main Types of Marine Cargo Insurance.

What are the Institute Cargo Clauses?

The Institute Cargo Clauses (ICC) are the gold-standard rules built into marine insurance policies, defining which perils trigger coverage for loss or damage to cargo—and which are excluded. Drafted by the London Underwriters Association, they standardize global trade protection, ensuring fairness from the Singapore Strait to the Suez Canal. At their core, ICCs outline the breadth of coverage: from comprehensive protection to essential essentials. For Malaysian SMEs financing through letters of credit, ignoring these clauses could result in non-compliance under Incoterms such as CIF, making adequate insurance mandatory for the seller.

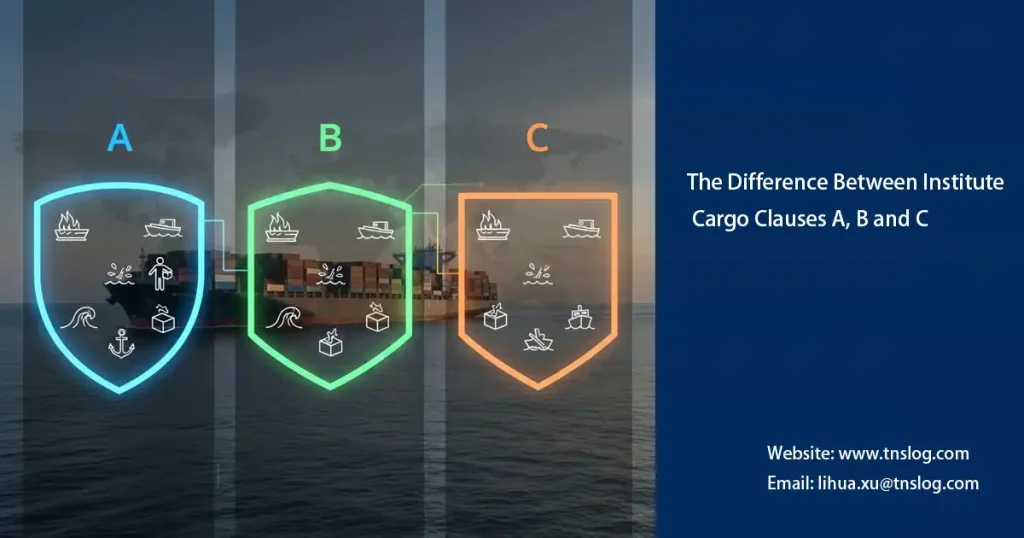

How Do the Cargo Clauses Differ?

The difference between Institute Cargo Clauses A, B and C boils down to risk appetite and cost. Clause A delivers the widest net, catching nearly every mishap; Clause B narrows to key named perils; Clause C is the leanest, targeting only catastrophic events. Premiums scale accordingly: A highest, C lowest—often 0.1–1.5% of cargo value, influenced by 2025’s climate hikes. This tiered approach lets you calibrate protection to your route’s volatility, like piracy-prone South China Sea vs. stable Baltic runs. Do you know the common causes of cargo damage in ocean shipping? Read “Top Causes of Cargo Damage in Ocean Shipping” to help you choose the terms better.

The Main Types of Institute Cargo Clauses

Here’s a no-fluff rundown of each, with real-world ties for exporters like you.

Institute Cargo Clause A: The All-Risks Powerhouse

Clause A—aka “all risks”—blankets your cargo against any fortuitous loss or damage from external causes, unless explicitly excluded (e.g., war, strikes, inherent spoilage, or poor packing). It covers collisions, theft, heavy weather, leakage, and even non-delivery, extending to containers and packing. For a Penang electronics exporter facing multi-modal hauls to Europe, this means reimbursement for everything from forklift crushes to saltwater intrusion.

Why the premium punch (0.5–1.5% of value)? It’s the most comprehensive, but exclusions like delays or cyber sabotage require add-ons. In 2025, with IUMI noting $50 billion in global claims, A’s breadth justifies the cost for high-stakes trades.

Institute Cargo Clause B: The Balanced Named Perils Option

Clause B steps back from A’s everything-but-the-kitchen-sink vibe, focusing on a curated list of specified risks: fire, explosion, collision, jettison, washing overboard, and seawater entry causing damage. It won’t touch theft, pilferage, or minor handling slips—those need extensions. Think of it as mid-tier armor for a Johor machinery shipment via the Indian Ocean: solid against major sea perils, but not everyday bumps.

Premiums sit comfortably at 0.3–0.8%, a sweet spot for moderate exposures. Drawback? Gaps in partial losses under 3% deductible mean more out-of-pocket for tweaks

Institute Cargo Clause C: The Budget Catastrophe Cover

Clause C is the minimalist’s choice, insuring only against total loss from big-ticket events: fire, explosion, vessel grounding/sinking, collision, or jettison—plus general average. Partial damages? Off the table unless linked to these (e.g., no solo rain wetting). For bulk palm oil tankers from Kuantan to China on low-risk routes, it’s efficient—covering the vessel’s doom but not selective spoilage.

At 0.1–0.5% premiums, it’s the cheapest, ideal for commoditized, hardy cargo. But in 2025’s era of frequent disruptions, its narrow lens leaves 40% of claims exposed, per TT Club insights.

Which Cargo Clause Fits Your Needs?

Picking the right ICC hinges on your cargo’s value, fragility, and route risks—not one-size-fits-all. Low-value bulks on safe lanes (e.g., grains to Japan)? Clause C keeps costs lean while meeting FOB basics. Semi-valuables like apparel via volatile straits? Clause B’s named perils strike the balance, slashing premiums 20–30% vs. A without skimping on majors.

For irreplaceables—think pharma or tech under CIF? Go Clause A for max reassurance, even if it stings the wallet. Factor 2025 trends: climate perils boosting A’s appeal by 15% in premiums, but worth it for uninterrupted cash flow. As your Malaysian forwarder, we crunch these with free audits—aligning clauses to Incoterms and banks like CIMB for seamless trades

Quick Comparison: ICC A, B, and C at a Glance

| Clause | Coverage Breadth | Key Perils | Premium Range (2025 Est.) | Best For |

|---|---|---|---|---|

| A | All risks (excl. specified) | Theft, weather, handling, collision | 0.5–1.5% | High-value/fragile (e.g., electronics) |

| B | Named perils + partials >3% | Fire, explosion, seawater damage | 0.3–0.8% | Moderate goods (e.g., machinery) |

| C | Major catastrophes only | Sinking, grounding, jettison | 0.1–0.5% | Bulk/low-risk (e.g., ores) |

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!