What is the difference between marine cargo insurance and marine hull insurance?

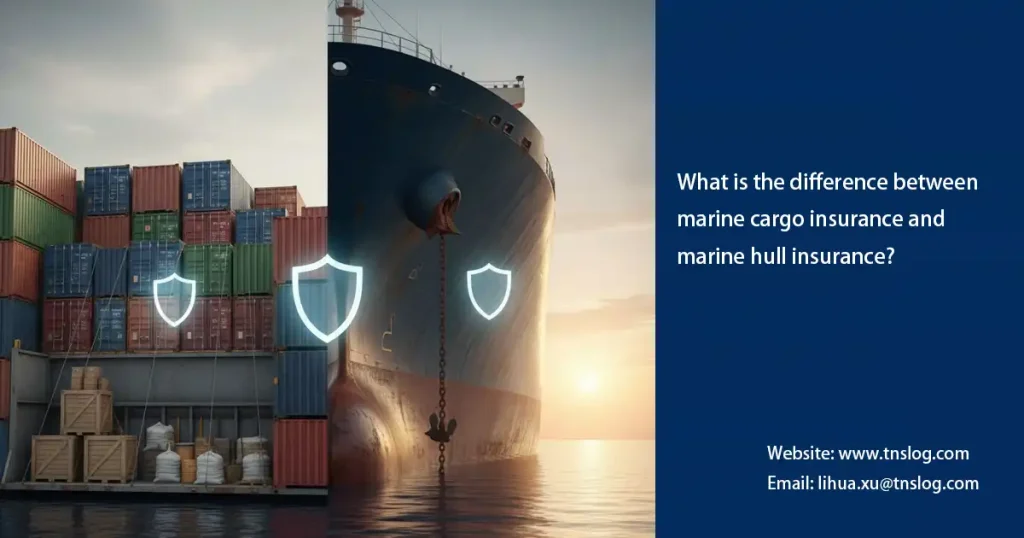

Do you know the difference between marine cargo insurance and marine hull insurance? In the complex world of international shipping, marine cargo insurance and marine hull insurance are often confused. They provide distinct protections—one safeguards your cargo from accidents while the other protects the structural integrity of the vessel. The differences between marine cargo insurance and marine hull insurance not only affect coverage, but also premiums, claims, and applicable entities. Understanding these differences can help you effectively hedge against potential losses in trade. Read on to uncover these key points and strengthen your global supply chain. If you’re new to marine cargo insurance, explore our in-depth guide, “How Marine Cargo Insurance Works in International Trade,” for a basic overview.

What is Marine Cargo Insurance?

Marine cargo insurance is a policy that financially protects goods being shipped by sea, air, or land from loss, damage, or theft during transit. It covers a range of risks such as natural disasters, accidents, sinking, theft, and fire, and provides a financial payout to the insured party to mitigate the financial impact of these events. This coverage is typically for the benefit of the shipper, importer, or exporter and can be for individual shipments or a blanket policy. In Malaysia, we facilitate billions of dollars in exports each year and this insurance is a must for compliance under Incoterms such as CIF.

Marine cargo insurance coverage

Marine cargo insurance coverage typically follows the Institute Cargo Clauses (ICC) of Lloyd’s of London, offering tiered protection:

- All Risks (ICC A): Broad coverage for any accidental loss or damage, excluding war, strike, or inherent vice (such as perishable goods).

- Named Perils (ICC B/C): Covers specific marine risks, such as fire, collision, abandonment, or overboard.

Key coverage includes theft, contamination, and shortages during loading and unloading. For tropical cargoes such as rubber exported from Malaysia, extended moisture damage clauses are common.

This policy provides warehouse-to-warehouse coverage, bridging the intermodal gap—critical for our route from Port Klang to Europe.

For a deeper dive into the variations, please see our article “Overview of Main Types of Marine Cargo Insurance.“

Who needs it?

Marine cargo insurance is crucial for shippers, exporters, importers, and freight forwarders like us, who don’t own the vessel but bear the risk of the goods in transit. If you’re a Malaysian SME exporting coffee beans to the US under FOB terms, you’ll need coverage until the goods arrive at the buyer’s port. Banks financing trade transactions also often require it to prevent loan defaults due to cargo losses.

What is Marine Hull Insurance?

Marine hull insurance is a type of insurance that covers physical damage to a vessel’s hull, machinery, and equipment. It protects against a wide range of perils like collisions, sinking, fire, heavy weather, and other accidents, much like car insurance but for ships. Policies can be customized to cover single vessels or entire fleets and may be extended to include other risks like war, construction, and third-party liability.

Marine Hull Insurance Coverage

Marine hull insurance complies with the Institute Time Clauses – Hulls (ITCH) and provides:

- Total Loss Protection: Full compensation if the vessel sinks, runs aground, or is declared a total structural loss.

- Partial Damage: Repairs for collision, fire, or mechanical failure, including salvage labor.

- Exclusions: Fair wear and tear or wilful acts. In our high-traffic region, a South China Sea Piracy Rider is standard.

This all-risks approach to marine hull insurance ensures rapid repairs and minimizes downtime—critical when delays to tankers can cost millions of dollars in demurrage.

Who needs it?

Marine hull insurance is tailored for shipowners, charterers, and operators who own or lease vessels. If you’re a Malaysian shipping company operating a palm oil bulk carrier, it’s a mandatory requirement due to flag state regulations and the collateral clauses of lenders like Maybank.

The key difference between cargo insurance and hull insurance

| Aspect | Marine Cargo Insurance | Marine Hull Insurance |

|---|---|---|

| Primary Asset | Goods/cargo in transit (e.g., electronics, commodities) | Vessel hull, machinery, and equipment |

| Key Risks Covered | Theft, damage from storms, contamination, non-delivery | Collisions, grounding, fire, piracy attacks on ship |

| Transit Focus | Per-shipment, warehouse-to-warehouse | Ongoing policy (e.g., 12 months) for vessel operations |

| Exclusions | Inherent vice (e.g., spoilage), delays | Ordinary wear, unseaworthiness |

Have Anything To Ask Us?

Please fill in your email in the form and we’ll get back to assist you soon!